The Governor of the Reserve Bank of Australia has done a hatchet job on talking down the Australian dollar towards a preferred target of $0.87.

Glenn Stevens signaled last week that the currency had more room to fall by flagging dovish view of RBA's monetary policy, citing Australia's weak economic growth and subdued inflation.

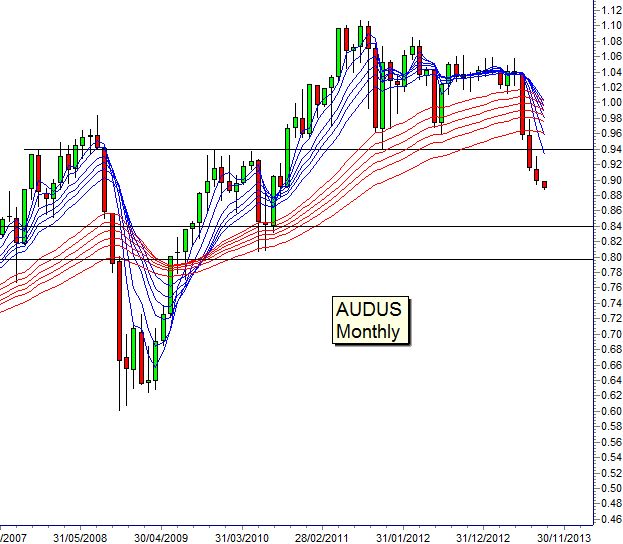

The comments exaggerated a sell-off in the currency which has fallen around 14 percent against the dollar this year, alongside a broad sell-off in commodities and on fears of a slowdown in China, Australia's biggest trading partner.

(Read more: Australia cuts rates to record low of 2.5%)

The Australian dollar may have rebounded slightly on Tuesday to trade near a 3-year low of $0.89, after the RBA offered no clear hints on further easing after a quarter point rate cut, but according to technical analysis, there is simply no reason to hold the currency.

The Aussie-U.S. dollar pair is simply, a carry trade that has collapsed.