As the economy slowly recovers, Americans are struggling to get out of credit card debt they amassed during tougher financial days.

The good news: the majority of people are paying their credit card bills on time. Recent data from the American Bankers Association shows that less than 2.5 percent of credit card accounts were 30 days late in the first quarter of 2013.

The bad news: they're amassing more debt. Outstanding credit card balances in the U.S. rose to $856 billion according to a study by the Federal Reserve Board.

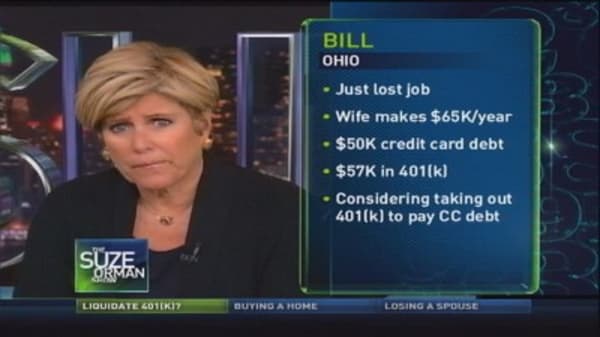

Out of desperation to stay current, or to rid themselves of their debt, people are looking at their retirement accounts as a cash source. But Suze Orman says that's the biggest mistake you could make.