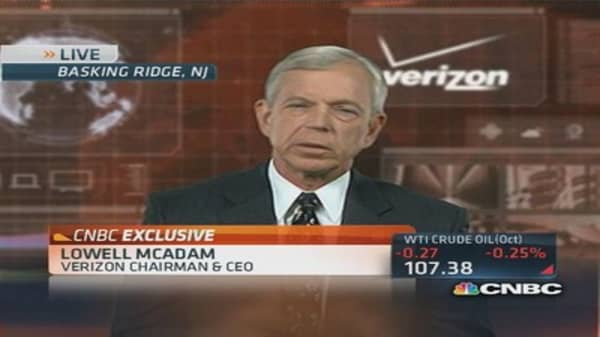

Verizon's buyout of Vodafone's portion of the wireless company will give it an edge in an industry where competition and consolidation continue to mount, said Verizon chairman and CEO Lowell McAdam.

(Read more: Vodafone CEO: We will invest in ourselves )

"You look at how the business has grown over the years—this is arguably the most valuable wireless asset in the world," McAdam told CNBC's "Squawk on the Street" on Tuesday. "We think that there is a great opportunity, and if anybody needs to be worried it ought to be T-Mobile and Sprint."

The complex offer, which includes cash and stock for Vodafone's 45 percent stake in Verizon, is the third-largest acquisition of any type in history and will require the biggest corporate bond issuance on record.

Verizon expects the deal with Vodafone to close in the first quarter of 2014.

(Read more: How should Vodafone spend Verizon's $130 billion? )

Many shareholders expected a deal this year, but speculation was for a price lower than the agreed-on $130 billion. McAdams said the acquisition price is fairly valued considering the financial and asset gains.