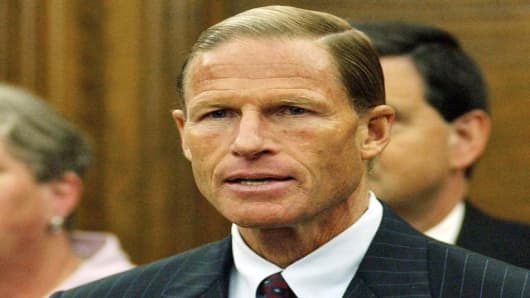

Connecticut's Attorney General Richard Blumenthal tells Bloomberg he's investigating a possible conflict of interest involving Warren Buffett's Berkshire Hathaway.

Berkshire owns a big stake in the credit rating agency Moody's, which recently gave Berkshire's new bond insurer a triple-A, its highest rating.

Berkshire is Moody's largest shareholder with 48 million shares as of the end of the year, worth almost $2 billion. Current price:

Blumenthal is quoted as saying he's looking at "the clear and direct conflict of interest for Moody's to rate a company owned by such a significant Moody's shareholder."

Blumenthal says it's part of a previously announced antitrust probe of the ratings companies that's already underway: "We have been aware of this issue, and it has been very actively and immediately involved in our investigation. This financial relationship is part and parcel of the issues involved in our antitrust investigation."