Emerging markets represent a lucrative yet dangerous option for an investor. You have to be a little bit of a maverick to invest in markets like Brazil, India, Turkey and Vietnam to name a few, because not only can you make a lot of money, you could just as easily lose your fortune.

But emerging markets have been faring pretty well the last five years, with the benchmark MSCI Emerging Markets Index rising more than 25 percent in 2007. According to Aberdeen Asset Management, by region, the Indian subcontinent was up 55 percent, whilst Latin America was up 35 percent over the year.

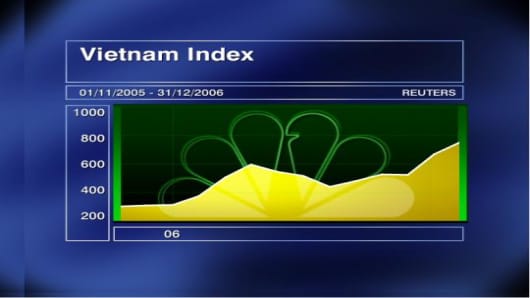

Charting Asia recently took a look at India's SENSEX. We thought we'd take a look at a smaller, yet equally as lucrative emerging market -- the Vietnam Index.

Falling stocks and markets, are the favorite hunting ground for long-term investors who look for stocks trading below their fair value. The Vietnam market rose spectacularly in 2006 - 2007. It also suffered an equally spectacular fall in 2008. Many investors are beginning to think this market is moving below fair value.

Markets always look for support. This develops when prices fall to levels irresistible to buyers -- something quite aptly called vulture buying -- where investors wait for the market to reach its lows before they become buyers.

People use many different methods to decide when the low price is most attractive. We use charting and technical analysis to understand how other people are thinking and how they are behaving in the market. The three most important Vietnam numbers are 320, 420 and 540.