Those who have been waiting to buy Apple on any sort of pullback will finally get their chance when the stock resumes trading this morning.

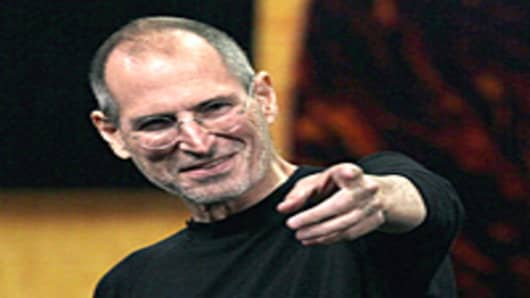

The news that company CEO Steve Jobs is taking a medical leave of absence less than two years after returning from a liver transplant sent shares of the world's most valuable tech giant falling in the pre-market. (Track Apple here)

And now some investors are asking some pointed questions about the company's succession plans.

"Jobs' health issues are something that have hovered over the company for almost seven years now," said Dan Nathan, Options Actioncontributor and JAK Securities' Chief Options Strategist

Nathan added that Apple's board should move forward with its succession plans and bump company COO Tim Cook to the CEO role sooner rather than later.

"The board needs to pave the way for Cook and his other executives to run a real, full new product cycle from inception to sales, to end user. Then investors will be able to get a glimpse of the company's ability to execute in Jobs' absence," said Nathan.

On last Friday's show, Nathan suggested a bearish bet on Apple .

Specifically, he recommended buying the February, 340,330,320 Put Tree for a total of ten cents, a trade that could be worth up to ten dollars if Apple stock falls about 8-percent and stays there by February expiration.

The strategy was recommended as a play on earnings, and with Apple trading lower in the pre-market, it's unlikely many investors were able to get the trade off at those prices, highlighting the obvious need to be aware of execution.

So what is Nathan's next move?

"With the stock down 5%, you probably don't want to put the trade on, but if you do, you should definitely use different strikes."

It should be noted that already the bulls are coming out of the woods. Kaufman Brothers raised its target to $415 from $395 just this morning.

Watch Options Actionon CNBC Fridays 5:30pm ET, Saturdays 6a ET and on Sundays 6a ET

Questions, comments send them to us at: optionsaction@cnbc.com