Stocks are under pressure as unrest continues in the Middle East and it’s had an even bigger impact on oil prices.

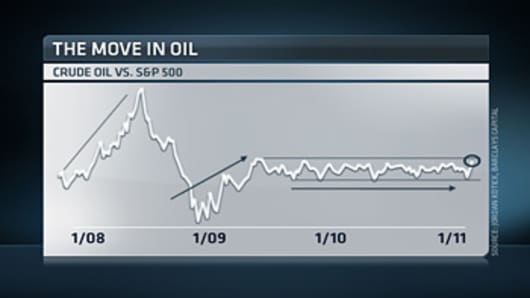

Our chart expert, Jordan Kotick pointed out “the rise in crude in 2008 was frenzied as it outperformed risky assets.” And since the bottom in 2009, crude prices have been on the rise, side by side with the equity market.

We’ll have to wait and see if this trend will continue. Kotick said, “a break of the range high, we are right near it, would suggest crude out-performance and a possible frenzied, Middle East catalyzed move.”

Kotick has been fairly bullish on crude prices for 2011 since Q4 of last year. However, he believes “the key is not that crude is going higher. It has been going higher for a year. The Middle East only supports a trend that is already going on. The key is whether crude will outperform the broader market.”