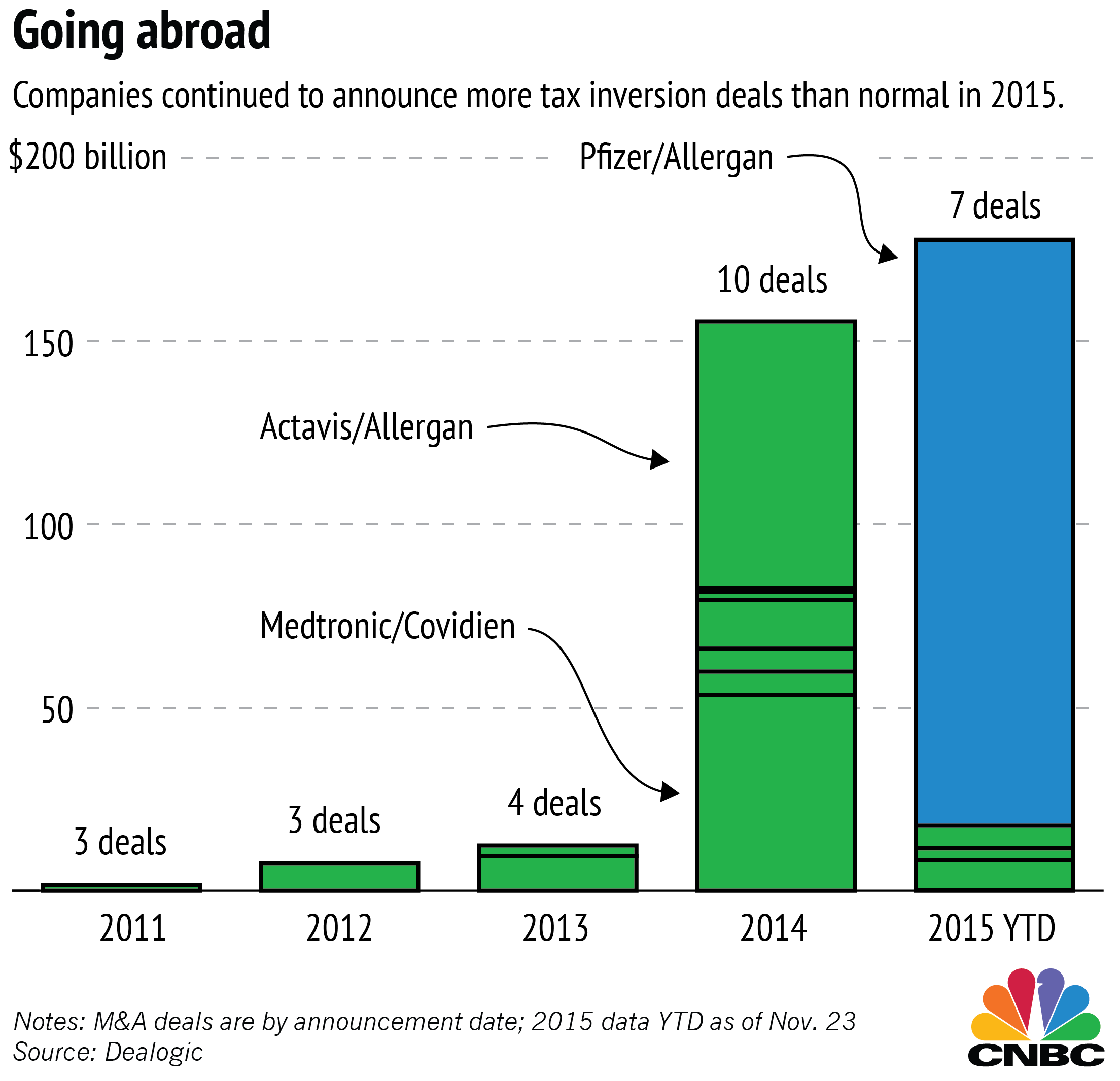

Pfizer's record-setting proposed purchase of Allergan for about $160 billion will not only be the biggest health-care sector deal ever, it will also be one of the largest tax inversions in recent history.

Tax inversions — deals in which a U.S. company gains the ability to domicile in a foreign country and trim its U.S. tax burden — are frowned upon by politicians and the Treasury Department. But efforts to penalize companies for making such deals seem to be falling flat.

The Pfizer deal announced Monday will push the total value of tax inversions this year to new highs. The number of such moves announced this year is also higher than was normal prior to 2014, according to data compiled by Dealogic.