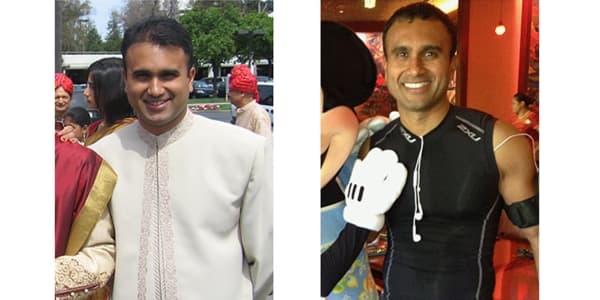

A lot can happen in a year.

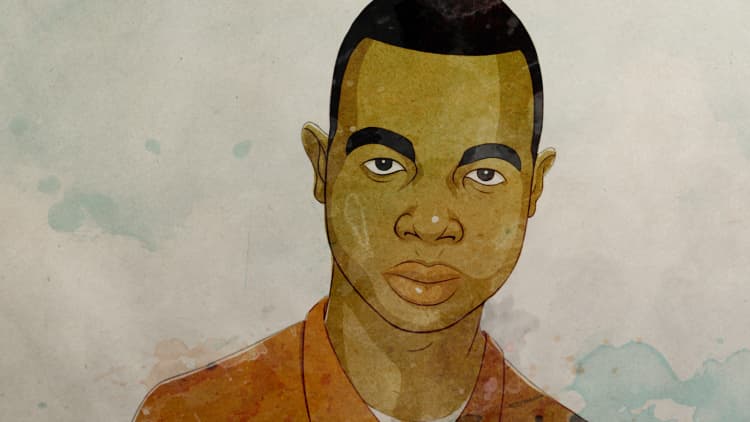

For Greg Walton, 32, one year made the difference between heading down a destructive path and getting his life on track.

These days the Brockton, Massachusetts, resident is a married father of two and an IT support engineer at the Massachusetts Institute of Technology.

It's a different world from his childhood — and miles away from that fateful day when he was arrested as a 19-year-old college dropout with about $20,000 in loans.

"One of the biggest turning points of my life was facing the reality that your choices can determine your future," said Walton.

"It really opened my eyes to realize I didn't want to be someone who was struggling, living out in the streets," he said.

Here's how Walton turned his life around after one of the darkest periods in his life.

Escaping instability

Walton grew up with his great-grandmother, aunt and uncle in Boston, following a brief stint in foster care with his older brother.

One of the biggest turning points of my life was facing the reality that your choices can determine your future.Greg Walton

Despite the rough start, Walton made his mark with strong grades and athletics.

"As a young boy, I was a pretty good student — honor roll a lot throughout my younger years and quarterback on the football team," Walton said.

He was also the first in his family to graduate from high school and go to college.

What should have been an auspicious start as an adult led to some of the most difficult times in Walton's life.

As part of his financial aid, he received some checks from school. The money was supposed go toward tuition, but he spent it instead.

It didn't help that Walton started to run with the wrong crowd — namely, a student who dealt drugs.

"By the middle of my sophomore year, essentially I left school," he said.

The final straw came when Walton, then 19, was arrested with an illegal firearm. He outran the police at first.

"Something in me said that I needed to stop," Walton said. "This needed to happen."

A second chance

Walton served a year in prison, and his finances languished. He incurred about $20,000 in student loan debt during his first two years of college, and the sum was due when he pulled out of school.

The loans went into default once he was imprisoned.

It was during Walton's time in prison that he took steps toward putting his life on the right track.

He reconnected with a high school guidance counselor who pointed him toward a program called Year Up, an organization that connects urban youths with mentors and career opportunities.

To make ends meet immediately after his stint in prison, Walton started working at a grocery store, earning $6.75 an hour.

Walton started at Year Up about six months after he served his time, building a career in IT. He finished the program in January 2007 and started working in MIT's IT department that June.

He's about to celebrate his 10th anniversary at the school.

Rebuilding funds

Walton married his high school sweetheart, Alicia, in 2009, kicking off some serious conversations about rebuilding his finances.

Alicia is a finance and human resources director at the Boys and Girls Club of Brockton.

Though the young engineer had been chipping away at his student loan balance since he got out of prison, he wanted to clear the decks and devote cash flow to other savings goals.

Working with his financial advisor Dimitry Neyshtadt of The Bulfinch Group in Needham, Massachusetts, Walton paid off the $7,000 balance on his student loan by borrowing from his retirement plan.

Even though tapping your 401(k) is often a bad idea, the interest rate on the student loan was higher than the rate he would pay for borrowing from his plan, Walton said. The repayment comes directly from his paycheck.

At the same time, the couple slashed their spending to save for a home. They downsized from a two-bedroom apartment rental to a single bedroom.

"The larger goal was to get rid of some of this debt as fast as possible and still allow yourself to be able to save," Walton said.

The couple closed on their new home in Brockton on Valentine's Day in 2011.

"It was incredible because we don't come from a background of people who buy homes," Walton said.

Planning ahead

These days, the Waltons have turned their focus toward a five-year strategy of eliminating credit card debt — while still being able to afford some family fun once in a while.

The family has about $25,000 in credit card debt, some of it stemming from the purchase of home furnishings. However, all of the accounts are being paid on time, Walton said.

Without the additional weight of student loans, those goals are within reach.

"We want to be that mid- to late-30s couple that can go on vacation and have a hefty nest egg for the kids to utilize," Walton said.