Parents of special needs children often find themselves staring down a seven-figure bill to cover the cost of lifetime care.

Coming up with that cash doesn't have to be impossible — if families know how to plan for it.

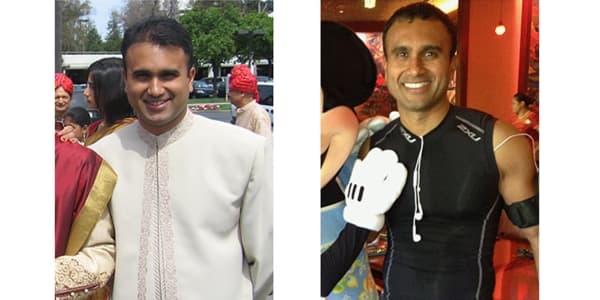

Such was the case for the Fernandez family of Newton, Massachusetts, a couple who needed $3 million to cover the cost of lifetime care for their 23-year-old son Alex, who has autism.

The family drafted a special needs trust and funded it with life insurance to ensure that they will provide for him long after they are gone.

That's just one strategy available to families to help them cover the cost of and support for their kids, all the while preserving benefits that their children may receive through the Supplemental Security Income (SSI) program and Medicaid.

There's also the ABLE account, a tax-advantaged savings account for disabled individuals that was created in 2014 through the Achieving a Better Life Experience (ABLE) Act.

"It's case specific, and it depends on your goals and resources," said Nancy Nauheimer, a wealth advisor with Northern Trust. "A good plan can include both a special needs trust and an ABLE account."

Here's how you can get the most out of your special needs planning.

Special needs trusts

Though Supplemental Security Income and Medicaid are instrumental in special needs planning, disabled individuals are subject to "means testing" in order to obtain those benefits.

This year, the monthly maximum for SSI benefits is $735 for an eligible individual and $1,103 for a couple.

Individuals with more than $2,000 in assets and couples with more than $3,000 won't qualify for the Supplemental Security Income program. A special needs trust can help them navigate this requirement.

A third-party special needs trust — also known as a supplemental needs trust — is created by family members and funded with assets that aren't owned by the disabled person, including life insurance and other property.

The benefit of using this trust is that the assets don't belong to the beneficiary, so they can go to other family members or to charity after his or her death, instead of going toward Medicaid reimbursement, said Nauheimer.

At the very least, you'll need a lawyer to draft the document, a trustee to administer the funds, and an accountant to handle the trust's income tax filings.

Trusts can be subject to steep income taxes. The top rate of 39.6 percent kicks in when income exceeds $12,500.

A simple special needs trust can cost between $2,500 and $3,000, but the expense will vary based on the complexity of the client's situation, the size of the firm handling the case and the attorney's billing rate, Nauheimer said.

Families will also need to review and update their overall estate plan to ensure that the special needs trust coordinates with it.

ABLE accounts

ABLE accounts allow families to sock money away for a beneficiary and have it grow on a tax-deferred basis. Distributions are tax-free if used for qualified disability expenses.

Beneficiaries must have been diagnosed with a qualifying disability by age 26.

These accounts can receive up to $14,000 a year in total annual contributions. In order for the beneficiary to remain qualified for government benefits, the ABLE account's balance must not exceed $100,000.

Proponents of these accounts tout their slimmer administrative structure compared to special needs trusts.

This makes the ABLE account friendlier for families who may not have millions of dollars to provide their children but have just enough to set aside each year.

A good plan can include both a special needs trust and an ABLE account.Nancy Nauheimerwealth advisor, Northern Trust

"You don't have the set-up costs, trustee selection, and trustee fees of a special needs trust," said Mary Morris, CEO of ABLEnow, a savings program offered by Virginia.

Once the beneficiary dies, Medicaid can file a claim for repayment of benefits. However, prior to that, the remaining balance of the account can be used by the estate to pay for any outstanding qualified expenses, including funeral and burial costs.

Accounts through ABLEnow don't have an enrollment fee and aren't subject to minimum contribution requirements.

Savers with less than $10,000 in the account can expect to pay a monthly service fee of $3.25 through ABLEnow. Asset-based fees ranging from 0.37 percent to 0.40 percent also apply if you choose investments.

Building a life care plan

It's not enough to just have money set aside for your loved one, be it in a special needs trust or an ABLE account. You'll need a written plan that will specify how you'd like your family member to be cared for.

Here's where to begin, according to Russell J. Fishkind, an estate planning attorney and partner at Saul Ewing LLP:

Establish your team: Funding care with a variety of assets can get complicated quickly, so you may want to coordinate with a team of experts, including an estate planning attorney, an accountant and a life insurance professional.

Create a life care plan: To provide your loved one with the best care, draft a document that will list his or her medical needs, social circles, dietary needs and the successor trustees involved. Detail the financial resources available, too.

"Many individual trustees are concerned about assuming responsibilities for a loved one," said Fishkind. "If you show them the resources are there and give them directions to dispense their fiduciary duty, it's not as daunting."

Review your beneficiary designations: The biggest mistake you can make is to name your special needs child as the beneficiary of a qualified plan or life insurance policy, as this will hurt his or her ability to get government aid.

"Integrate your beneficiary designations with your special needs plans so that the insurance or qualified plans go right into the trust and the beneficiary doesn't lose government benefits," Fishkind said.