After President Donald Trump disbanded his strategic and manufacturing councils as top CEOs denounced his reaction to the fatal violence at a Charlottesville, Virginia, protest, Jim Cramer expected the stock market to collapse.

But it didn't.

Instead, the Index, the Dow Jones Industrial average and the Nasdaq composite all traded upward and equities traded normally on the day's other news.

And while the "Mad Money" host hates talking politics, he acknowledged that the new administration's inaction has somehow paved the way for U.S. businesses to keep making money hand over fist.

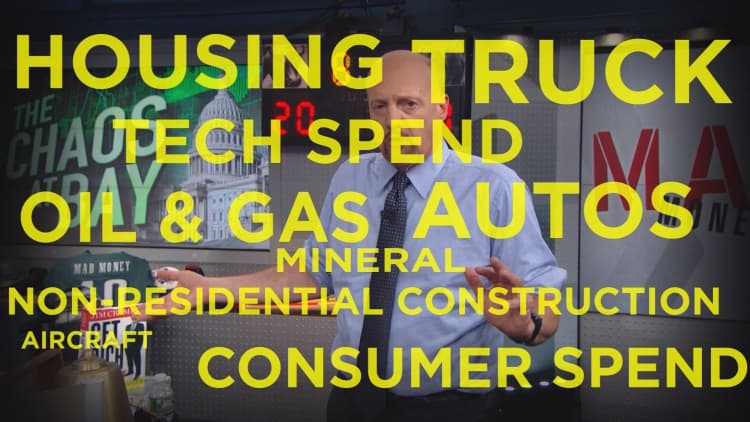

"The reason? Listen, you need to understand that the business world is made up of cycles," Cramer said. "There are all sorts of cycles. There's the housing cycle, the consumer spend cycle, the auto cycle, the tech spend cycle, the non-residential construction cycle, the truck build cycle, the oil and gas cycle, the mineral cycle, the aircraft cycle... a lot of cycles. And other than autos and the oils, all of these other cycles are in the sweet spot."

Standing Up to Amazon?

As major U.S. retailers continue earnings season with their quarterly reports, Cramer spotted some that managed to fend off the storm cloud that is e-commerce giant Amazon.

"Despite the endless onslaught from Amazon, not every retailer is rolling over here. We're starting to see some chains that can actually compete, that can even win, in this difficult new environment," the "Mad Money" host said.

Cramer started with TJX Companies, an off-price retailer that beat Wall Street estimates with its second-quarter results, raised its full-year guidance and saw its same-store sales, a key metric for the retail sector, grow by 3 percent.

"TJX put on a clinic about what you can do to beat Amazon: experiential opportunities, treasure hunt environment, lower prices for branded goods than the online colossus can offer," Cramer said.

Etsy vs. Shopify: Who Wins in Retail And Tech?

As competition across the retail industry heats up, Cramer unveiled some less traditional options for investors tired of brick-and-mortar stocks and wary of Amazon.

The "Mad Money" host classified Etsy and Shopify as "small business facilitators," or technology companies that help small- and medium-sized retailers work through the tough part of selling their goods online.

Both companies came public in the spring of 2015, and while Etsy had a tough start on the trading floor, the stock has come back since last year. Shopify, on the other hand, has more than doubled year-to-date, up 120 percent for 2017.

"In short, Etsy's an internet-based marketplace, Shopify's a set of tools that helps you build your own online store. While both stocks have done very well this year, there's no denying that Shopify's been a better performer for the whole period of time that these two companies have been publicly traded," Cramer said.

And although Shopify's growth story has been better overall, Etsy accepted and has so far fended off a challenge from Amazon Handmade, the e-commerce giant's own marketplace.

"Shopify and Etsy both look good, and while Shopify's been a stronger performer historically, I think that Etsy's the cheaper stock [and] might have a better risk-reward," Cramer concluded. "That said, I recommend waiting for the next market pullback if you like either stock, and I like the stock of Amazon better than both."

Valeant Pharmaceuticals CEO: Challenging Comeback

Overhauling the highly controversial Valeant Pharmaceuticals hasn't been easy, new CEO Joe Papa acknowledged on Wednesday.

"I will say, first and foremost, it's been a challenging 15 months, to be clear. But we've made great progress as a team," Papa told Cramer.

Papa stepped into his role at a time of great scrutiny for Valeant. The company was fielding criticism for an array of issues including price gouging and accounting irregularities.

The last time Papa was interview on "Mad Money" in May 2016, the drugmaker's stock had dropped 85 percent in the past year on the sordid revelations.

But since Papa took over as CEO, the company has made some strides, selling off a dozen non-core assets, turning its focus to research and development and tackling its massive debt.

Kirkland Lake Gold CEO: Shining On

Finally, Cramer spoke with Tony Makuch, the president and CEO of Kirkland Lake Gold, a Canadian company that opened trading on its common shares at the New York Stock Exchange on Wednesday.

"The reality is, no matter what we do, whether we're mining gold or doing anything, we're here to make money. And we're a profitable gold mining company," Makuch told Cramer on Wednesday.

Kirkland owns mines in Canada and Australia, having made three acquisitions in 2016 that took it from being a single-asset mining player to a mid-tier gold producer.

Makuch said that operating in those countries allowed Kirkland to work with governments that "are modern-thinking and have progressed."

Given the recent uptick in tensions between the United States and North Korea, Makuch agreed with Cramer that the price of gold should be higher.

"Yeah, I think it should be higher, it could be higher," the CEO said. "And that's why we put our investment in gold. We think gold is the right thing to be not only producing, but it's also the right thing to be investing ourselves in."

Lightning Round: Cheers To Dan Schulman

In Cramer's lightning round, he flew through his take on some callers' favorite stocks:

PayPal: "[CEO] Dan Schulman is remarkable. He has taken a company that so many of these analysts were burying and he has made it into a powerhouse. Yes, the stock is a buy, even up here at $60."

Marriot International: "I think you should be [interested]. I didn't think that the announcement, the earnings, really should've triggered any sort of cut. I think it was a buying opportunity."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com