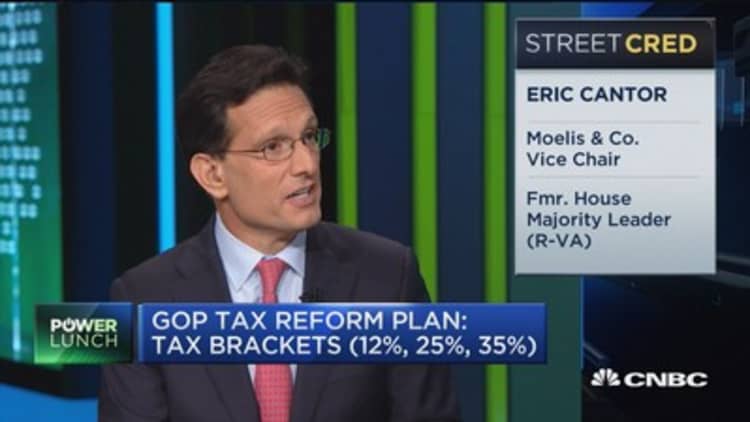

Republican leaders need to take a hard line on tax reform right now, but "all of this is up for negotiation," former House GOP Majority Leader Eric Cantor told CNBC on Thursday.

The Republican tax proposal, unveiled Wednesday, calls for a reduction in the corporate tax rate to 20 percent from 35 percent, collapses the current seven personal income tax brackets to three and doubles the standard deduction for individual taxpayers.

"This is an ugly process and there's going to have to be give and takes," Cantor said in an interview with "Power Lunch."

One thing the Trump administration and GOP leaders have said will not be touched is the 20 percent corporate rate. On Thursday, top White House economic advisor Gary Cohn told CNBC it was "nonnegotiable."

Also Thursday, House Speaker Paul Ryan told CNBC, "We are just as committed as the White House is to holding" the 20 percent rate on corporate taxes.

The nine-page plan did not offer specifics on how the cuts would be paid for. However, the administration has signaled that a popular deduction for taxes paid to state and local governments will be eliminated. Doing so would hit Democratic voters hardest, according to IRS data.

Cantor said there has to be significant "pay-fors," and eliminating state and local deductions "is a big one."

"How that offsets with the doubling of the standard deduction will be critical in these blue states where taxes are higher," he said.

However, Cohn told CNBC that the entire tax cut will be paid through economic growth.

As for whether the tax plan will actually pass, Cantor believes the odds are "pretty good." However, it will be difficult.

"There is a reason why there hasn't been overall major tax reform since the 1980s," he said.

— CNBC's John Schoen contributed to this report.