When stocks run higher in spite of tragedy and turmoil, CNBC's Jim Cramer finds it helpful to check in on the CBOE Volatility Index, the market's fear gauge commonly known as the VIX.

"When investors are scared, the VIX shoots higher; when they feel confident, the VIX goes lower," the "Mad Money" host said. "When you look at the action in the VIX relative to the action in the , it can give you a great deal of insight into where stocks might be headed."

Market experts have called last month the "least volatile" September ever. While Cramer pointed out that the VIX has only been actively traded for 13 years, he has noticed its low readings.

So Cramer turned to technician Mark Sebastian, the founder of OptionPit.com and Cramer's colleague at RealMoney.com, for help sorting out the action.

Historically, August tends to be the market's most volatile month, followed by September and October. But after spiking briefly this August, the VIX plunged in September despite rising tensions between the United States and North Korea and general disarray in Washington.

And it has been falling since. That caught Cramer's eye because the VIX's long-term average floats around 17 or 18, but in 2017, the VIX's highest close (in August) was just above 16.

Cramer also pointed out that of the 36 times the VIX has closed below 10 since it started trading in 2004, only eight of those closes happened before 2017. Now, the VIX has been trading below 10 for five days in a row.

"In short, this is unprecedented. It's almost as though this market has forgotten how to feel fear," Cramer said.

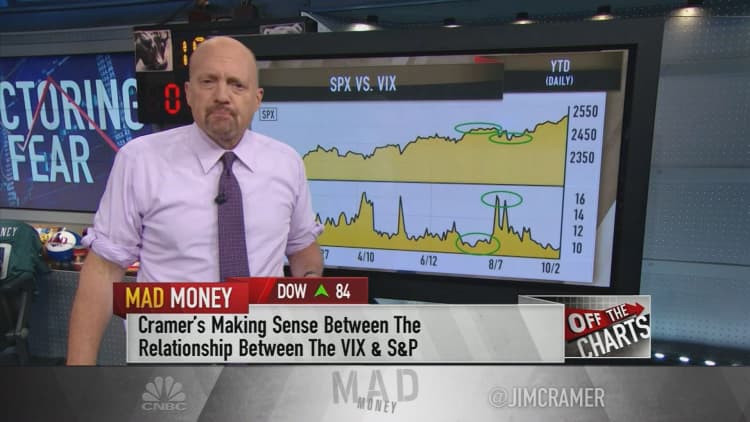

But looking at the VIX alone won't help make sense of the broader market, so Cramer and Sebastian presented a chart showing the action in the VIX and the S&P since the start of 2017.

Here's how to look at a chart like this: when the S&P rises, you should want the VIX to fall, proving that the rally is real. If the VIX is rising while the market's falling, that means the decline will probably last. When the VIX and the S&P are going in the same direction, it usually means a reversal is coming.

The last time Cramer turned to Sebastian was on Aug. 1, when the VIX was rising in tandem with the market. Sebastian worried the market would drop, and sure enough, it sold off shortly after.

But now, the charts are telling a different story. While market watchers may squawk about an imminent correction, the S&P keeps surging higher and the VIX keeps heading lower.

And while Cramer was quick to point out that the market's "fearlessness" may not last forever, seeing as the VIX was trading at similar levels in 2006 and 2007 before the financial crisis hit, Sebastian thinks it would take something drastically negative to jolt the market off course.

"For the moment, the action in the volatility index, as interpreted by our VIX expert Mark Sebastian, suggests that this fabulous stock market, at least for the bulls, could have even more room to run," Cramer said. "And it wouldn't surprise me one bit if he turns out to be right, especially since, historically, the last three months of the year tend to be pretty positive for stocks, especially if they've been up."

WATCH: Cramer's charts unveil the fate of fear in the market

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com