The contest for who will become the next head of the Federal Reserve appears to be coming down to two pretty different choices.

In recent days, market participants have become more focused on former Fed Governor Kevin Warsh and current Governor Jerome "Jay" Powell. While Warsh has long been considered a front-runner to head the central bank, Powell has emerged only lately as a compromise candidate who may just get the nod.

Fed watchers are keeping a close eye on PredictIt, a predictions market site that is seeking to handicap who will take the reins when current Chair Janet Yellen's term expires in February.

President Donald Trump has indicated he will make a decision in a few weeks. He has met with both Powell and Warsh, as well as Yellen and Gary Cohn, the president's chief economic advisor.

As of Tuesday morning, PredictIt puts Powell in the lead, with a 40 percent chance, while Warsh had a 30 percent likelihood. However, the market is thinly traded and volatile, as all four of the candidates have been in the lead at one point or another.

There are similarities between the two — both likely would favor at least a bit of a looser hand regarding banking regulations and might not be so quick as the Yellen/Ben Bernanke Fed to intervene when the stock market tumbles.

However, there are also considerable differences, particularly in what would trigger interest rate moves and how the Fed proceeds with reducing its $4.5 trillion balance sheet, which mostly contains bonds it bought to stimulate the economy during and after the financial crisis.

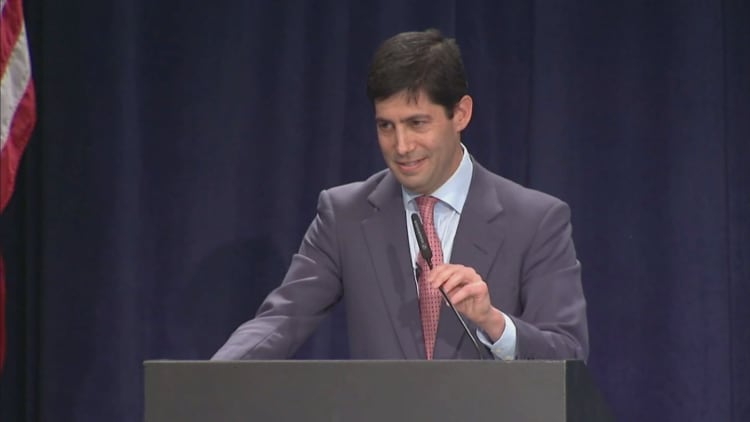

Krishna Guha, head of global policy and central bank strategy at Evercore ISI in Washington, also sees Powell and Warsh as the leaders of a pack that once included more than half a dozen candidates. To sort them out, he compiled a scorecard of how either might be expected to lead the Fed given the chance.

A few highlights:

A Warsh Fed

Currently a distinguished visiting fellow at Stanford University's Hoover Institution and former member of an advisory committee to Trump, Warsh could be expected to:

- "Represent more of a break with the Bernanke/Yellen era and would seek to style himself more on the (Alan) Greenspan model," with tighter policy and less intervention.

- Take a "more aggressive" approach to shrinking the balance sheet. Under the current plan, the Fed will let a limited amount of proceeds from maturing Treasurys and mortgage-backed securities run off. Under Warsh, it might seek an outright sale of MBS.

- Seek a Fed less dependent on economic data and more reliant on trends, while still switching to an approach that would be more rules-based when determining policy moves.

- "Warsh would welcome the opportunity to dispel beliefs about a Fed put by not responding to a mid-sized fall in the stock market," Guha wrote. The Yellen/Bernanke Fed advocated the asset purchase program that seemed to come at times when share prices fell sharply.

- Possibly end the Fed's practice of releasing quarterly projections for the economy and the level of the benchmark funds rate used to determine interest rates. The forecasts are often inaccurate and are criticized for misleading market participants.

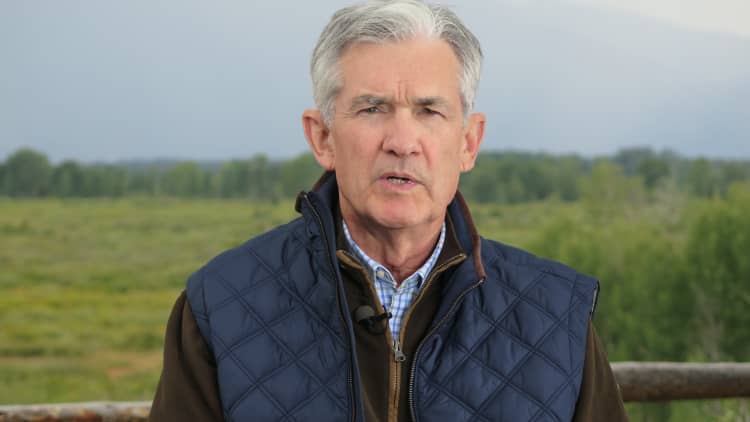

The Powell Fed

A former investment banker and partner at the Carlyle Group, Powell also served as a Treasury official under former President George H.W. Bush. A Powell-helmed Fed would likely:

- "Represent more continuity with the Bernanke/Yellen era" though he is not an economist by trade.

- Let the balance sheet decline in a more gradual manner than Warsh would prefer, with the final total around $3 trillion.

- Be resistant to adopting the hard-and-fast rules that some of the Fed's congressional critics advocate.

- Have a more open mind about deregulation, specifically regarding the Volcker rule that prohibits banks from trading for their own gain, and the annual stress tests that seek to determine the industry's ability to withstand another financial crisis.

- Be more committed than Warsh to ramping up inflation to the 2 percent level the current Fed believes is healthy for a growing economy.

Though there's been a steady flow of news and speculation about the new Fed chair — much of it anticipating that Yellen now stands little chance of renomination — market reaction has been mild. Reports of Warsh's ascension were greeted by a rise in government bond yields, and Guha expects that would continue to be the case. He also believes Powell's nomination might push the stock market higher.

"Financial market behavior over the past month suggests that the market would be comfortable with either candidate," he wrote. "We note that the market response to a new chair's nomination is not of course the test that ultimately matters: that test is the new chair's ability to promote full employment, price stability and financial stability through this cycle and the next."

WATCH: Powell offers his views on a number of issues concerning the Fed.