And it's that fear of making spending cuts that's fueling so many bad ideas to raise revenue instead.

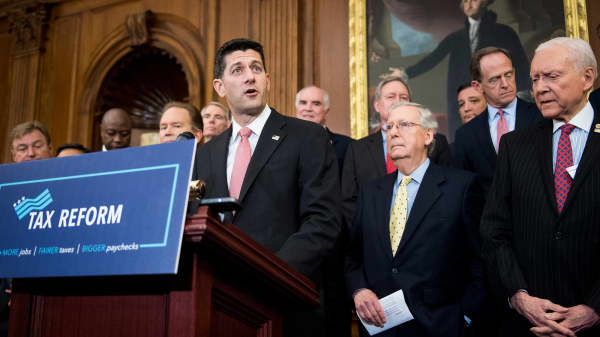

Here are the leading members of that Hall of Shame:

They floated the Border Adjustment Tax idea that America's retailers rightfully opposed as a move that would have hurt some of the nation's poorer consumers.

They're looking to eliminate or slash the state and local tax deductions that would bring brutal overall federal tax bill increases to people living in highly-populated coastal blue states.

They've floated the idea of limiting tax-free contributions for 401(k) plans that could destroy the retirement plans for millions of Americans who rely on those plans.

And now we have this similar push on mortgage interest tax breaks that's drawing massive ire from home builders, realtors, and others who believe such a move would really hurt home prices and values.

And Republicans still think all of these ideas and the extreme anger that comes with them are better than what they'd face from some common sense spending cuts?

All of these ideas come with more negative baggage than any accusation that the Republicans are spendthrifts or irresponsible on deficits. Compare that problem with being blamed for rising prices at the store, hurting retirees, cratering the housing market, and inflicting cynical financial pain on people living in Democratic Party dominated states.

The truth is, there really is no comparison and the Republican leadership is particularly tone deaf not to see that. But somehow, that leadership is still pressing on with an obsession over revenues and deficits.

The bottom line is the GOP doesn't believe in the simple, across-the-board tax cuts that President Ronald Reagan promoted so unapologetically 36 years ago. Economists will argue for decades to come over whether those tax cuts he got through Congress were the reason for the economic boom of the 1980s. But that boom is undeniable as GDP grew by as much as 7.8 percent at the height of the economic turnaround in the years immediately following those tax cuts.

Not all of the blame lies with the congressional Republicans. President Trump has let this go way too far. On one hand, he's promoted a message on tax reform that always very simple and persuasive. He talks about the "biggest tax cuts ever," and has cited a study that says the corporate tax cut plan could lead to $4,000 in wage growth for American families.

But while he delivers this clear message, he hasn't put a stop to the GOP in Congress continuing to work on those complicated and contradictory ideas that create more and more problems. The same guy who riddled his presidential campaign with controversial statements and continues to have little trouble calling out his political opponents with public insults isn't calling for Congressional Republicans to drop the arduous schemes and just cut the taxes and the spending. What exactly is he afraid of?

This is no way to run a government or win over the voters. And unless something big changes in their thinking and strategy, the Republicans are dooming the tax reform effort from within.

Commentary by Jake Novak, CNBC.com senior columnist. Follow him on Twitter @jakejakeny.

For more insight from CNBC contributors, follow @CNBCopinion on Twitter.