CNBC's Jim Cramer told investors to hang on to the stock market's "benign" action on Friday ahead of another potentially raucous week of earnings.

"You combine a good, not too hot, not too cold non-farm payroll number from the Labor Department that had little wage inflation, throw in some blockbuster earnings and voila, you get the kind of benign action that gives you multiple opportunities to make money," the "Mad Money" host said.

From the skyrocketing shares of Apple and the stabilizing health care space, Cramer saw plenty of opportunities in Friday's market, but wondered if they would follow through to next week.

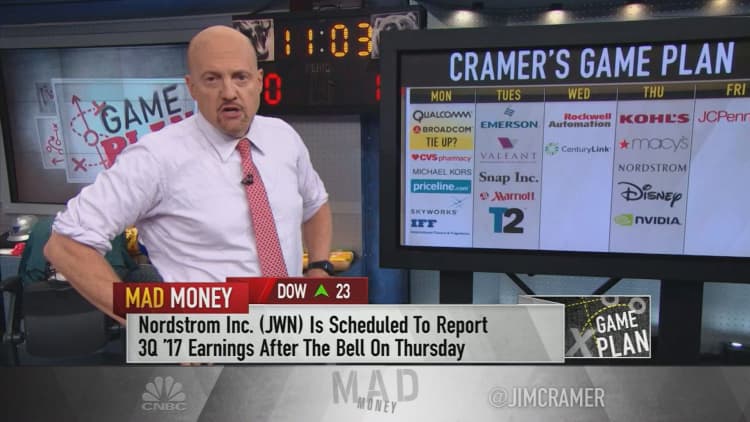

With that in mind, Cramer turned to the stocks and events he'll be watching next week:

Monday: Qualcomm, CVS Health, Priceline

Qualcomm: The semiconductor maker's stock has been flying on rumors that it could get a takeover bid by Cramer-fave Broadcom as early as this weekend.

"It seems like this quarrelsome semiconductor company — look, it's always locked in litigation over royalties — might finally catch a break," Cramer said. "Let's just say if this deal does happen, it would give the red-hot semiconductor rally yet another leg."

CVS Health: An earnings report from CVS could bring news connected to the drugstore chain's hopes of acquiring a health insurer like Aetna, Cramer said.

Priceline: Travel website operator Priceline will report earnings after Monday's bell.

"If you think back to competitor Expedia's quarter, which was nasty, you might get heartburn when you see this one, or at least some agita," Cramer said. "These companies actually want to win and that means they play for keeps. And when you do that and you go head to head, it always hurts your profit margins."

Tuesday: Emerson Electric, Marriott International, Take Two Interactive

Emerson Electric: Cramer expects a very strong quarter from this industrial company, but said it could be tarnished if Emerson raises its bid for Rockwell Automation.

Marriott International: This consistent growth company should see benefits from a "scarcity of lodging properties" around the world when it reports its earnings results, Cramer said.

Take Two Interactive: The parent of the wildly popular "Grand Theft Auto" video game franchise also reports after Tuesday's bell, but given the negative action after Electronic Arts' and Activision Blizzards' quarters, Cramer suggested investors wait to see the results before buying.

Wednesday: CenturyLink, Snap Inc.

CenturyLink: Cramer gets a lot of questions about this landline telecommunications company, which reports its earnings on Wednesday.

"Specifically, I get asked about whether CenturyLink's 13 percent dividend is safe," Cramer said.

"The truth is, I'm always worried about any company with a 10-percent-plus yield. That's usually a sign that there's a dividend cut coming. I'm calling that one problematic."

Snap: Speaking of problematic, the social media giant that is Snap reports after Wednesday's close.

"I bet Snap will give it the old college try — I mean, didn't these guys just get out of college? — and the Street will rally around it, but all in all, I think you should forget Snap."

Thursday: Macy's, Disney, Nvidia

Macy's: This retailer's stock his a 52-week low on Friday. Ahead of its earnings report next Thursday, Cramer (and all of Macy's sellers) worried that the company wouldn't be able to maintain its 8 percent dividend.

"I don't know, we have to hear what CEO Jeff Gennette says, but I can't see why he'd have to cut it barring a huge shortfall," the "Mad Money" host said.

Disney: Cramer expects the entertainment giant's earnings report to be more of the same that the market has gotten in its last few quarters.

"Subscriber losses [and] cord-cutters will overwhelm all the amazing positives from the movie business and theme parks and advertising," he said. "At least the consensus is that the stock will do nothing, and even if it's wrong, I bet that view will dominate the action in the stock."

Nvidia: Even though this Cramer-fave semiconductor stock has run so much, the "Mad Money" host still sees a lot to like, particularly given the strong demand for chips for self-driving cars and graphics processors used for gaming systems like the Nintendo Switch.

"But the stock does have a habit of trading down after it reports, so I want you to wait until we hear the conference call before you do any buying," Cramer said.

Friday: J.C. Penney

Bedraggled department store chain J.C. Penney already pre-announced its dismal earnings ahead of its scheduled Friday report. Cramer doesn't expect what management says on Friday to reverse the stock's decline.

Final Thoughts

"The flood of earnings continues next week and that means it will be almost impossible for you to take everything in and make rational decisions. Even the best portfolio managers can't," Cramer said. "My recommendation? During the cacophony of earnings season, don't make any snap judgments — wait until you've heard the conference calls before you do anything, any trading."

WATCH: Cramer goes over his weekly game plan

Disclosure: Cramer's charitable trust owns shares of Apple, Broadcom, Activision Blizzard and Nvidia.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com