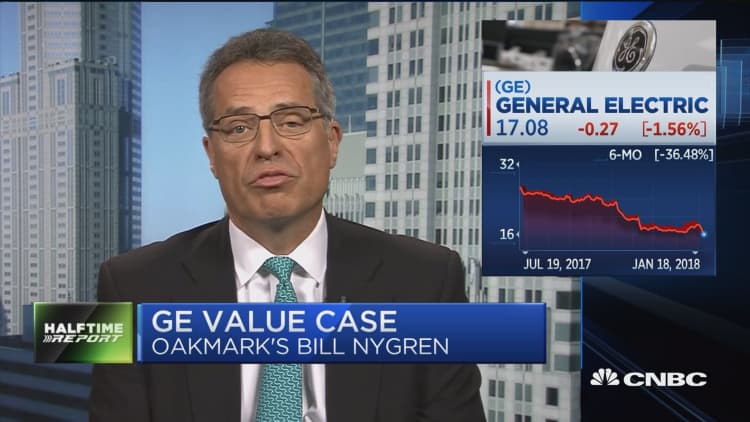

Oakmark's Bill Nygren shared his market views and top stock ideas in an interview Thursday on CNBC's "Halftime Report."

General Electric was "the worst performing stock in our portfolio. We were seriously off," he said.

However, he added his fund is sticking with its position and expressed confidence in the industrial company's new management team.

"In this case, there has been a tremendous change in people," the investor said. "We think [their businesses] deserve better than average multiples. We think with a fresh look GE deserves to be in the portfolio."

John Flannery succeeded Jeff Immelt as General Electric's CEO in August.

Nygren said his fund owns more shares of General Electric after some buying and selling, but it is a smaller percentage of its portfolio compared with last October.

General Electric shares hit a six-year low Thursday. The company disappointed Wall Street analysts Tuesday after it announced a larger-than-expected $6.2 billion after-tax charge for the fourth quarter in its GE Capital insurance portfolio.

The investor also revealed his fund sold its Microsoft shares and bought new positions in American Airlines, CVS Health and Priceline.

Nygren joined Harris Associates, the investment advisor for Oakmark Funds, in 1983. He manages the firm's flagship Oakmark Fund, which has $19.5 billion in assets. His fund has outperformed the S&P 500 over the past 10 years and since inception through December.