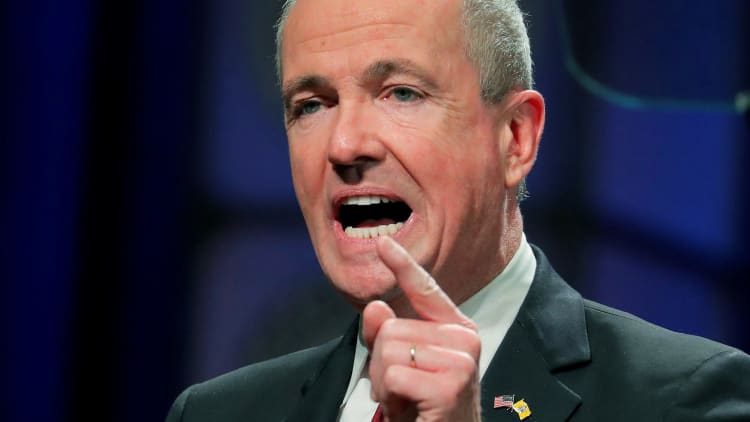

New Jersey needs relief from the "horrific" Republican tax law, the state's new governor, Phil Murphy, told CNBC on Monday.

"It's political. It takes it out on the middle class," the Democrat and former Goldman Sachs executive said in an interview with "Closing Bell."

He argued that more than 80 percent of the benefits will ultimately go to the top 1 percent. "We'll do what it takes to push back on this," Murphy said.

The central issue is the new $10,000 cap on property, state and local income tax deductions (SALT). Under the previous law, the deduction was unlimited.

High-tax states such as New Jersey and California are hardest hit by the change. In 2015, New Jersey residents, on average, claimed nearly $20,000 in SALT deductions.

Murphy told CNBC the options could be creative and/or through the legal system.

A lawsuit is already in the works. Last Friday, New York Gov. Andrew Cuomo announced New York, New Jersey and Connecticut plan to sue the federal government.

Cuomo argued the new tax code "preempts the states' ability to govern by reducing the ability to provide for their own citizens and unfairly targets New York and similarly situated states in violation of the Constitution."

However, Murphy on Monday mentioned other potential solutions, such as the ability to convert tax payments into charitable contribution payments to the town. That would allow taxpayers to take a deduction.