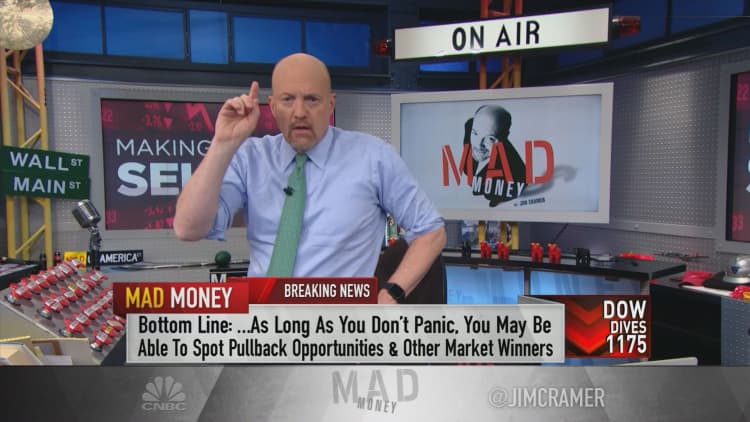

As the stock market plunged on Monday, taking the Dow Jones industrial average down almost 1,600 points intraday, CNBC's Jim Cramer wanted to help investors assess the drop.

"I hate to sound glib here, but ... we were due for a decline. We just were," the "Mad Money" host said. "Markets do not go up in a straight line."

Cramer noted that, on average, 5-percent pullbacks occur at least three times a year. Monday's weakness led the market to close down 8 percent from its high on Jan. 26.

"Despite the large, scary red numbers you see on your screen, the truth is that these things happen. You've got to be ready for them ... at all times," Cramer said.

First, Cramer analyzed the causes of the sell-off. Bullish exuberance, rising interest rates, declines in key stock sectors and weak-handed shareholders all contributed to the losses, but Europe really "got the ball rolling," he said.

When he woke up on Friday and noticed the European exchanges in the red, the "Mad Money" host knew some of the pain would be felt across the Atlantic.

But when interest rates also started climbing after a strong U.S. jobs report that showed the highest year-over-year increase in wages since 2009, Cramer really smelled trouble.

"I can't stress the importance of this enough," he said. "Higher wages, I find, are terrific for people who work for a living, but wage inflation is scary to investors ... because it means the Federal Reserve might be forced to tighten more aggressively than we'd been expecting."

So, with Europe slumping, bond yields surging and two weaker-than-expected earnings reports from Alphabet and Apple hanging over the tape, the market began a sell-off that continued into Monday.

Whenever the entire market takes a hit like this, Cramer likes to take a counter-intuitive route and look for stocks that can hold up or even rally in spite of the tape's turmoil.

One such stock was that of e-commerce giant Amazon, which gained nearly 40 points on Friday after delivering an earnings beat on Thursday.

But Cramer grew concerned with Amazon when it closed down nearly 3 percent on Monday.

"Not a good sign. We wanted [Amazon] as a leader, but it may be a chance to buy," the "Mad Money' host said.

"Special situations" like paper plays International Paper and WestRock also inched up on Friday, though they gave back some of the gains on Monday.

"The reason? A combination of consolidation — WestRock is buying KapStone — ... and the fact that paper stocks are cyclical[s] that haven't run nearly as much as, say, the chemicals," Cramer explained. "While WestRock and International Paper did get hit hard today, that's the kind of special situation that I write down" as interesting potential buys.

Finally, Cramer noted that, with the exception of Wells Fargo, the banks represent one of the market's most attractive groups because they are key beneficiaries of rising interest rates.

"Here's the bottom line: harsh sell-offs are miserable to live through, ... but they are unavoidable. They are part of investing. This one was long overdue. As long as you can stop yourself from panicking, you will do well ... and will be able to identify the opportunities that are being created, like the bank stocks away from Wells, while also spotting the winners who refuse to quit even when the market's down more than 1,000 points, like Amazon," Cramer said. "If this is how it trades in a bad market, imagine what that stock will do when things stabilize. Oh, news flash: things do stabilize. They always do."

WATCH: Cramer tracks the sell-off's damaged goods

Disclosure: Cramer's charitable trust owns shares of Alphabet and Apple.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com