U.S. stocks surged on Friday, pushing the Nasdaq composite to a record, after February jobs growth far exceeded expectations.

The tech-heavy advanced 1.8 percent to 7,560.81 and hit intraday and closing records, erasing the losses from last month's correction. The Nasdaq 100, which is made up of the 100 largest companies in the Nasdaq composite, also reached a record high. Friday marked the first time since Jan. 26 that either index reached a record high.

Shares of Facebook, Amazon, Netflix and Google helped lead the gains.

The Dow Jones industrial average rose 440.53 points to close at 25,335.74, with Goldman Sachs among the biggest contributors of gains to the index. The 30-stock index also closed above its 50-day moving average, a key technical level.

The gained 1.7 percent to end at 2,786.57, with financials as the best-performing sector. It also closed above its 50-day moving average.

"This jobs report was the perfect slice of pizza," Kevin Mahn, president and chief investment officer at Hennion & Walsh, told CNBC's "Power Lunch" on Friday. "It did reaffirm the underlying strength of this economy, but it also diminished some of those inflationary concerns and the potential that there could be more than three rate hikes this year."

The U.S. economy added 313,000 jobs in February, according to the Bureau of Labor Statistics. Economists polled by Reuters expected a gain of 200,000.

Wages, meanwhile, grew less than expected, rising 2.6 percent on an annualized basis. Stronger-than-expected wage growth helped spark a market correction in the previous month.

"As far as the market is concerned, you couldn't have scripted it any better," said JJ Kinahan, chief market strategist at TD Ameritrade. But "it still remains a mystery how you can create these many jobs and not have wages go up more."

The Cboe Volatility Index (VIX), widely considered to be the best gauge of fear in the market, hit its lowest level since Feb. 1 and traded more than 11.5 percent lower at 14.62.

A "solid jobs number with lower wage numbers has muted inflation concerns," said Jeff Chang, managing director at Cboe Vest. "This has dampened the fears we saw in the equity markets early last month. With the VIX below 16, you could be seeing investors reducing their hedges to these concerns."

The moves Friday came after Wall Street finished on a positive note on Thursday, following more developments concerning tariffs.

President Donald Trump signed two declarations on Thursday, which would implement tariffs on steel and aluminum imports. The tariffs are expected to take effect in 15 days and will put a 25 percent charge on steel, and 10 percent on aluminum. Canada and Mexico however are exempt.

"I'm glad to see Canada and Mexico [were] spared in the latest tariff initiatives," said Peter Boockvar, chief investment officer at Bleakley Advisory Group, in a note. "But, 75% of our trading partners were slapped. I get that China was the real target here but we import 13% of our steel from Brazil, 10% from South Korea, 5% from Japan, 4% from Germany and 3.5% from Taiwan to name some others."

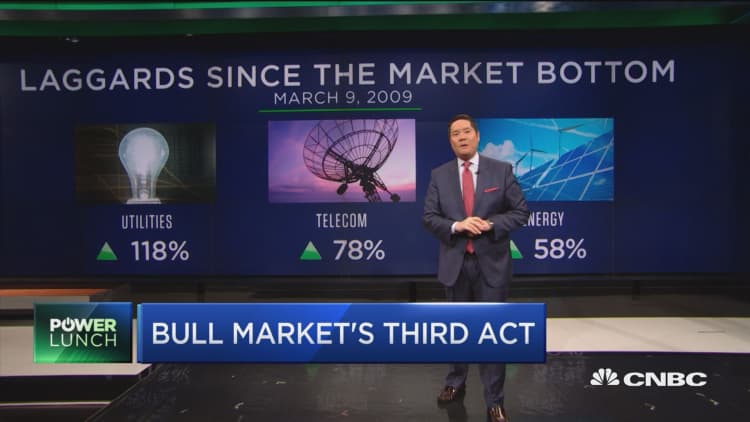

Friday also marked the nine-year anniversary of the bull market. It also marks the "Haines Bottom." Before the open on March 10, 2009, CNBC anchor Mark Haines called the bottom of the financial crisis on air.

On March 9, 2009, the S&P 500 closed at 676.53. Since then, the S&P 500 is up around 300 percent. Consumer discretionary is the best-performing sector in that time period, rising more than 550 percent. A theoretical $10,000 bet on Amazon would be worth $250,000 today.

In corporate news, Goldman Sachs closed 1.7 percent higher after a report said CEO Lloyd Blankfein is preparing to leave the company by year-end.

Boeing CEO Dennis Muilenburg told Reuters the company has "plenty of cash horsepower" to make acquisitions, such as the proposed tie-up with Brazil's Embraer. Boeing shares rose 1.7 percent on Friday.

Shares of Mattel fell 7.1 percent amid news Toys R Us may liquidate its U.S. operations. Mattel is a Toys R Us debt holder.

WATCH: What's happened to stocks since Haines bottom