President Donald Trump's latest tariff plans sent the market into negative territory on Wednesday. But Tony Dwyer, chief market strategist at Canaccord Genuity, told CNBC that investors shouldn't worry about trade tensions or tariffs.

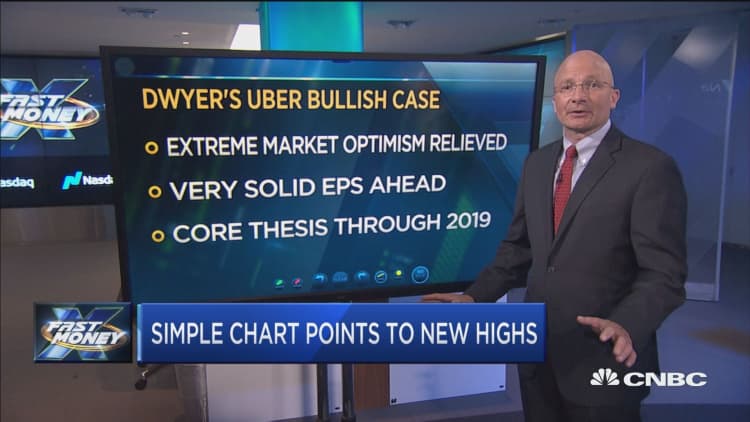

“The market moves with the direction of earnings," Dwyer said Wednesday on "Fast Money." "As long as the economy is positive, that direction of earnings is going up.”

In fact, he predicted the upcoming earnings season will be "unbelievable."

"This quarter alone we’re probably going to be close to 24 percent growth rate versus a year ago in S&P operating profits," he said.

Still, market watchers were on edge Wednesday as all three major indexes closed lower. On Tuesday, Trump announced plans for another round of tariffs: 10 percent on nearly $200 billion worth of Chinese goods. This comes in addition to the $34 billions of tariffs on Chinese imports imposed less than a week earlier.

But Dwyer said volatility is normal and warned investors not to sell.

"Unless [the tariffs have] enough power to make earnings go negative," he said.

"Outside of a very clearly identified recession period, you don’t want to sell weakness," Dwyer said. "You want to buy it."