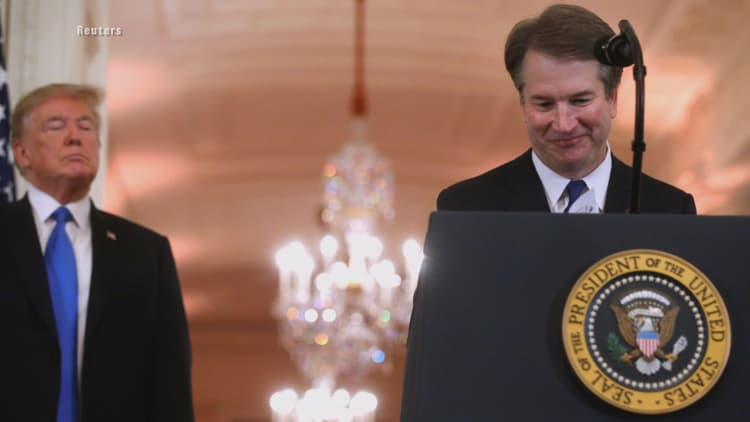

It appears even nominees to the highest court in the land aren’t immune to getting up to their eyeballs in credit card debt.

Brett Kavanaugh, President Trump’s nominee to replace retiring Supreme Court Justice Anthony Kennedy, had accumulated somewhere between $60,000 and $200,000 in debt on three credit cards and one personal loan by 2016, according to required disclosures he has submitted as a federal judge.

The White House has attributed the debt largely to season baseball tickets to the Washington Nationals for himself and friends and home improvement projects, according to a Washington Post report. Kavanaugh’s latest disclosure, filed in May, shows no credit card debt for 2017 and a loan from his retirement savings plan whose balance is under $15,000.

While it’s unknown exactly how much debt Kavanaugh carried — the form only requires that filers report the amount in ranges — or what interest rate Kavanaugh paid, even the low end reported ($60,000) is a liability that could cripple many households.

The average interest rate on credit cards is nearly 17 percent. Using that rate: If you paid off $60,000 over, say, three years by making monthly payments of $2,139, you’d pay about $17,000 in interest. In other words, that original $60,000 would cost you $77,000.

If the debt was $200,000 — the potential high end that Kavanaugh carried — and you paid it off over three years with monthly payments of $7,130, the interest paid would be more than $56,000.

“The finance charges on credit cards are too high to justify carrying a balance, even temporarily,” said Greg McBride, chief financial analyst at Bankrate.

Credit card debt among U.S. consumers has climbed above $1 trillion, the highest it’s ever been. At the same time, interest rates have been creeping upward as the Federal Reserve continues nudging a key rate higher that affects consumer debt.

“Credit card debt is only becoming costlier as interest rates rise,” McBride said. “Every time the Federal Reserve boosts benchmark interest rates, you can expect that higher rate to be reflected on your credit card within one to two statement cycles.”

More from Personal Finance:

Most Americans would give up social media to erase credit card debt

Five money mistakes that can destroy a marriage

Already, the Fed has raised rates seven times in the last two years and is expected to boost its key rate at least one more time this year.

If you find yourself among consumers who are facing mounting credit card bills, here are tips to try paring down your debt.

Consider transferring your balance

If your credit score is high enough to qualify for a offer, consider taking it.

While these deals typically come with a balance-transfer fee, the zero percent interest rate can last anywhere from a few months or a year to a couple of years. At the end of the deal, the remaining balance begins accruing interest at the then-current rate.

Not only do you avoid paying interest on the debt, you can potentially pay it down more quickly because all of your payment will go toward the balance instead of some going toward interest.

Strategize your repayment efforts

If you have multiple credit cards, start by funneling most of your repayments toward the one with the highest interest rate. In other words, pay the minimum on the lower-rate cards and put any extra you possibly can toward the debt that's costing you the most in interest.

Once the most expensive debt is paid off, move to the card with the next-highest rate.

Here’s the main takeaway: Pay the balance in full every month. Don’t charge things you can’t afford to pay for right away.Greg McBrideChief financial analyst for Bankrate

Alternatively, you can pay off the lowest balances first, which can help give you a sense of accomplishment and momentum to continue tackling your debt. However, you can count on paying more in interest.

While credit cards can come with benefits such as purchase protection, cash back or rewards points, they generally only work to your advantage if you avoid carrying a balance.

"Here’s the main takeaway: Pay the balance in full every month,” McBride said. “Don’t charge things you can’t afford to pay for right away.”