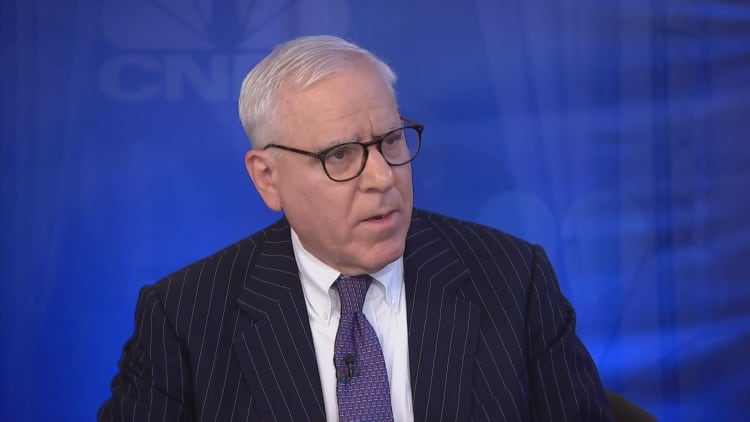

Additional interest rate hikes won't hurt the economy, David Rubenstein, co-founder and co-executive chairman of Carlyle Group, told CNBC.

"We think the economy is in reasonably good shape and can take two more 25 basis-point increases this year without any real disruption," Rubenstein said Wednesday on "Power Lunch" at CNBC's eighth annual Delivering Alpha conference in New York.

In June, the Federal Reserve hiked its benchmark short-term interest rate a quarter percentage point and indicated that two more increases would likely happen before year's end.

Some investors believe additional rate hikes could invert the yield curve, which could signal economic problems and potentially slow down the economy.

But while Rubenstein said it's good to be cautious, he doesn't see "any evidence of a slowdown."

"You have to assume that you’ll have some slowdown in the next five or six years and at that point be prepared for it," he told CNBC's Becky Quick at the conference Wednesday.

On Tuesday, Federal Reserve Chairman Jerome Powell testified in front of Congress that he doesn't see any reason not to move forward with two more rate hikes this year.

"Right now, I think [Powell] feels the economy is doing reasonably well, and I do too," Rubenstein said.

WATCH: Jerome Powell says best way forward is to raise interest rates