The Federal Reserve's policy of normalizing interest rates is appropriate because the U.S. economy has recovered on all fronts, according to the chairman of J.P. Morgan Chase International.

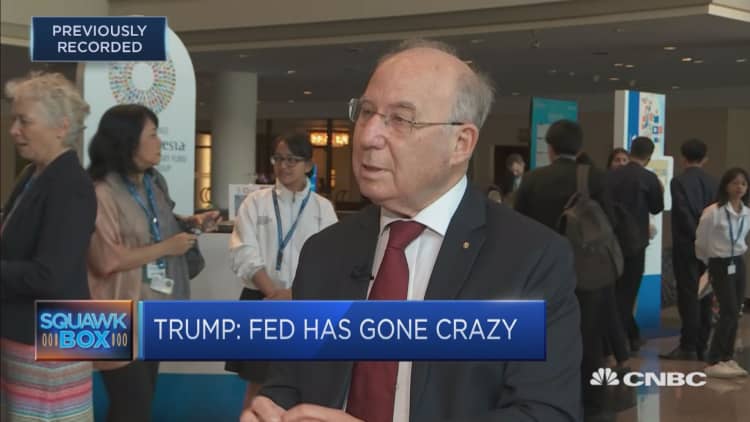

In the U.S., inflation is at the Fed's target, growth has recovered, labor markets are very good and unemployment is low, Jacob Frenkel told CNBC's Nancy Hungerford at the IMF and World Bank annual meetings in Bali, Indonesia.

"That's the time to normalize," he said. "The Fed has announced it in advance, there are no surprises. Guidance was very clear and the Fed is doing the right thing."

The central bank has raised interest rates three times this year and is largely expected to hike once more before year-end. Its most recent rate hike in September drew criticism from President Donald Trump at the time.

On Wednesday, the president doubled down on his criticism after walking off Air Force One in Erie, Pennsylvania for a rally. "I think the Fed is making a mistake. They are so tight. I think the Fed has gone crazy."

Frenkel told CNBC that it is not up to the U.S. president to make such statements.

"There are two issues: Have they gone crazy? And is it up to the president to declare this medical situation? I think that the answer is 'no' to both," he said.

"It's not a good idea for the president to get into these details because at the end of the day, the Fed is a very professional entity. It has the data, it has made the analysis, it has the reputation and it is moving forward and serving the United States and the world economy," Frenkel added.

Market sell-off

Trump's latest comments came as markets sold off sharply, with the Dow Jones Industrial Average dropping more than 800 points on Wednesday. Market commentators cited various factors that contributed to the sell-off, including fear that the Fed will raise interest rates aggressively and that escalating trade tensions between the U.S. and China will drive up business costs.

Frenkel said he didn't think the sell-off had anything to do with rising interest rates.

"I believe that the rising rate environment is a matter of fact. There is nothing new over there, it was completely anticipated, and, in fact, I can tell you now that there will be another rate hike, most likely later this year," he said.

Instead, he pointed to the "trade skirmishes" between the U.S. and China that, he said, were spilling over all other markets.

"What it tells you (is) that the two giants of the world economy, China and the United States, do not agree with each other," he said. "And we're passengers on this airplane and the two co-pilots are fighting. How would you feel? You will fasten your seat belt, you will be nervous and that's very bad for everyone."

Ultimately, Frenkel said he expected a compromise to happen between Beijing and Washington. The issue, however, is what kind of damage will happen along the way, he said: "So, yes, long term optimism, short-term challenges."