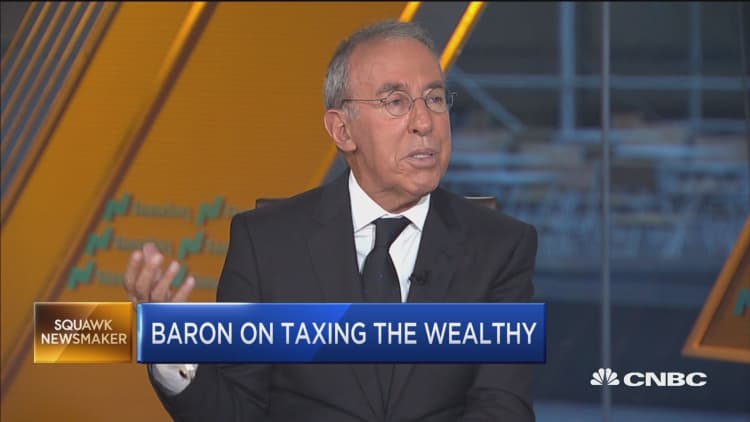

Buy-and-hold billionaire Ron Baron said Thursday that the economic and political system in the United States works well, but also contended the extremely wealthy should pay higher taxes.

The founder of Baron Capital, which has $28.3 billion in assets under management, said that capitalism works for people if "they are educated and are able to take advantage of the system."

"I don't think it's fair for people not paying taxes who are earning a great deal of money," Baron told CNBC's "Squawk Box." "I do think it's fair for people like me paying 50 percent in taxes." He suggested that if he were really worried about the amount of taxes he's paying that he "could live in Florida and pay a 30 percent tax."

Baron currently lives in New York City. He also has a sprawling estate in the Hamptons on Long Island, where the Big Apple elite escape the hustle and bustle of the city. However, Baron wasn't always rich. He grew up in and around the New Jersey beach city of Asbury Park. His parents were government workers.

On Capitol Hill, Democrats such as Massachusetts Sen. Elizabeth Warren and New York Rep. Alexandria Ocasio-Cortez are pushing the wealthy to pay their "fair share of taxes."

Warren, who is running for president in 2020, is proposing an additional 2 percent tax every year on households with assets over $50 million and 3 percent on households with assets over $1 billion. Ocasio-Cortez, a self-described democratic socialist, wants a 70 percent marginal tax rate on income above $10 million.

Baron — who has a net worth of $2.2 billion, according to Forbes — has made a fortune by doing extensive research, buying the stocks of what he feels are undervalued companies, and keeping them for an average of about 14 years.

Asked whether he's concerned about Democratic policies that could impact his wealth, Baron said his life goals are not "to make money so I can spend" on different things. "I wanted to build a business that's going to last to be able to provide services to individuals who are going to be able to take care of their families."

Among the wealthy business leaders who agree with Baron is Bill Gates, known for co-founding Microsoft and giving billions of dollars away to charity. In an interview with The Verge, Gates said he supports "more progressive" taxes on the rich, but proposals targeting high-income brackets, like a plan from Ocasio-Cortez, are too narrow.

Billionaire entrepreneur and philanthropist Richard Branson also believes that taxing the wealthy "makes sense." The Virgin Group founder said on CNBC that the extremely affluent have a responsibility to tackle some of the biggest problems in the world, including wealth disparities.

Watch: Why legendary investor Ron Baron is betting big on Tesla