With record levels of student loan debt, it's no wonder recent graduates don't save for retirement.

Studies show that college grads with student loans only save about half as much as those without loans by the time they're 30. Some employers recognize how difficult the debt burden can be — and are trying to help.

For example, last June, Abbott rolled out its Freedom 2 Save program, which helps employees pay down their student debt while staying on track with their retirement savings.

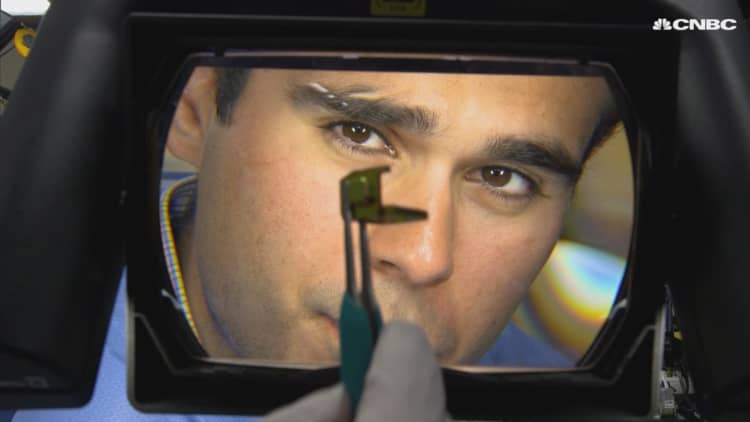

That's what sealed the deal for Harvir Humpal, 24. The biomedical engineer had three job offers coming out of graduate school last year — and about $60,000 in student loan debt.

"I'm a new graduate, so student loan debt is something that's going to be a part of my life for at least the foreseeable future," he said.

More from Invest in You:

Here's the No. 1 reason why employees quit their jobs

Simple ways to craft a perfect social profile for job hunting

Here are 5 myths about side hustles you can't afford to ignore

As long as Humpal uses 2% of his salary to pay off his student debt, the health-care company will make a 5% pre-tax contribution to his 401(k) — even though he's not contributing a dime to his retirement account. The money is fully vested in two years.

"Over the long haul, that's about four years less of paying off student loans and ultimately that's $7,000 less in student loan interest," Humpal calculated.

About 7 in 10 seniors graduate with debt, owing around $30,000 per borrower, according to data from Student Loan Hero. Overall student debt stands at a more than $1.5 trillion, according to the Federal Reserve.

Americans are now more burdened by college loans than they are by credit card or auto debt. Still, few employers are offering student loan repayment assistance.

Now, about 8% of companies, including Aetna, Fidelity and PwC, offer taxable contributions to help employees repay student loans, up from 4% three years ago, according to the Society for Human Resource Management's 2019 Employee Benefits survey.

More than 750 companies are administering education debt benefits to their employees through Gradifi, a Boston-based firm that designs student loan repayment programs for companies.

Ninety percent of workers with student loans said they would like to work for a company that provides a student loan repayment benefit, Gradifi also found.

One obstacle is that the payments are considered taxable income for the recipients, and employers can't claim a deduction for these payments. New legislation aims to make this assistance tax free, up to a certain amount.

In February, members of Congress introduced the Employer Participation in Repayment Act (H.R. 1043), which would let employers give tax-free student loan assistance up to $5,250 a year per employee. Both federal and private loans would be eligible.

"Expanding employer education assistance helps address the skills gap, which is holding back both workers and employers," SHRM President and CEO Johnny Taylor, Jr. said in a statement.

"When employers are able to help workers pay off student debt, more people will have confidence to pursue higher education and be better prepared to fill high-skilled fields."

A companion bill was also be introduced in the Senate. A summary of the legislation can be found here.

Check out Ryan Serhant of 'Million Dollar Listing': 4 questions to ask before you buy a home via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.