The underlying message by the Federal Reserve — after it cut interest rates on Wednesday — may not be as hawkish as many investors had interpreted it to be, according to the chief economist of Institute of International Finance.

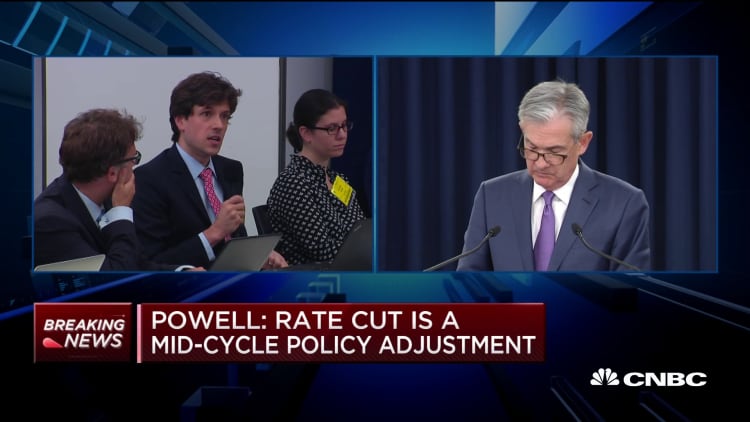

Stocks in the U.S. fell after Fed Chairman Jerome Powell suggested policymakers were not embarking on a new cycle of rate cutting. The 25 basis points cut on Wednesday marked the central bank's first policy easing in more than a decade.

But Robin Brooks, managing director and chief economist of IIF, suggested that the central bank may not be done with cutting rates.

"I think the midcycle adjustment language that Chairman Powell used is important," Brooks pointed out. "The midcycle adjustments that we saw in '95 and '98 were 75 basis points each — so three cuts each. And I think that is actually pretty close to what the market was pricing going into this meeting."

So, the central bank's move and Powell's comments on Wednesday aren't "much of a hawkish surprise at all," Brooks told CNBC's "Squawk Box" on Thursday.

"My basic point here is: I think markets here need to chill a little bit and the underlying theme is more dovish than ... markets perceived."

Brooks also pointed to the so-called dot plot of the Fed, which is a visual and anonymous representation of where U.S. central bankers think rates will go over the short, medium and longer term. He noted that seven out of 17 of them projected rates would drop by 50 basis points this year.

The fact that "a large group of seven people" were expecting two rate cuts in 2019 "kind of got lost in the commentary" that followed the Fed's latest move, said Brooks.

Brooks is not the only economist suggesting that the U.S. central bank could lower interest rates even more. Goldman Sachs analysts wrote in a Wednesday note that they "see an 80% cumulative probability of another cut at some point this year."

"Markets have priced a much deeper cutting cycle and took today's news as somewhat hawkish," said the Goldman analysts. They said Powell's comments are "consistent with our expectation that easing will end" with a second 25 basis points cut.

Watch: Fed's Powell defends 25 basis point cut during news conference