Credit Suisse reported higher-than-expected net income for the third quarter of 2019 on Wednesday.

The group posted net income of 881 million Swiss francs ($886.9 million), a 108% increase from the 424 million Swiss francs reported for the same period last year. Analysts polled by Reuters had expected a net income figure of 816 million Swiss francs.

Here are the key figures for the third quarter:

- Net revenues hit 5.3 billion Swiss Francs, versus 4.8 billion Swiss francs for the same period last year.

- Total operating expenses came in at 4.11 billion Swiss francs, versus 4.15 billion for the third quarter of 2018.

- CET1 ratio stood at 12.6% versus 12.9% a year ago.

The group also doubled its return on tangible equity to 9.0% from 4.5% in the third quarter of 2018.

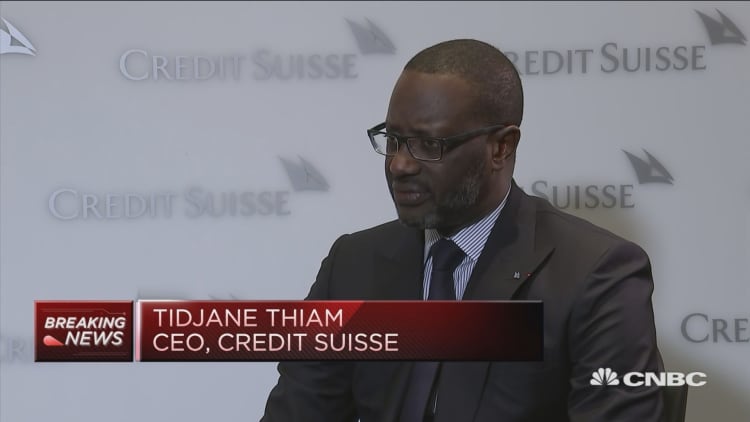

Speaking to CNBC Wednesday morning, Credit Suisse CEO Tidjane Thiam praised the performance of the group's investment banking and wealth management franchises against a challenging environment.

"Last year, there was a lot of debate on whether we had restructured enough or we should do more restructuring, and we said 'no, we have a good platform, now we need to give them a chance to show what they can do' and the results have been really, really excellent."

In its outlook, the group said it expects headwinds from the "ongoing challenging geopolitical environment" to persist into the final quarter of the year, most notably Brexit and the U.S.-China trade dispute.

"This is likely to lead to more cautious capital expenditure and investment decisions," the statement added.

Thiam told CNBC's Joumanna Bercetche that "the fundamentals that drive our numbers are healthy."

"The wealth management and the diversification of our platform, that continues to work. Now some parts of our activity, particularly look at IBCM (Investment Banking & Capital Markets) which is very difficult this quarter, our primary activity across markets has dropped down, are more challenging and are more market dependent," he added.

Credit Suisse is emerging from a turbulent quarter after a spying scandal which saw Chief Operating Officer Pierre-Olivier Bouee resign over the botched surveillance of former wealth management head Iqbal Khan. An internal investigation subsequently cleared CEO Tidjane Thiam of any wrongdoing.

The European banking sector is battling for profitability in an environment of long-term negative interest rates from the European Central Bank.