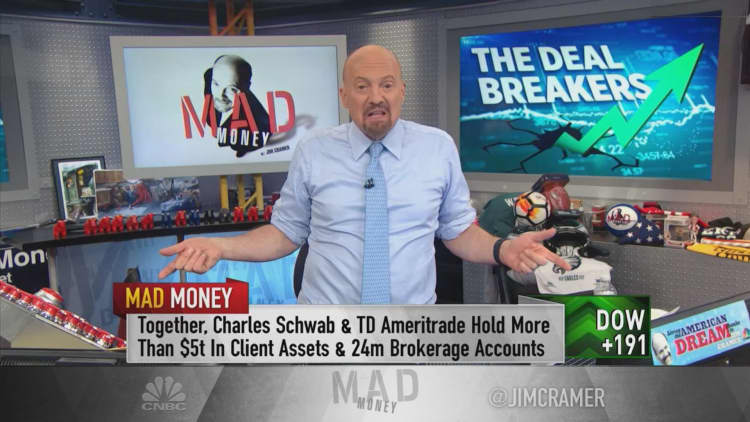

Charles Schwab is buying TD Ameritrade. LVMH is buying Tiffany. Novartis is buying Medicines Company.

And the market reaction to all these deals should be treated as evidence that stocks are not as overvalued as some experts have suggested, CNBC's Jim Cramer said on Monday.

"When the buyer's shares go higher, that tells you the market approves of the deal," Cramer said, and he added it helped contribute to record closes on the major market indexes Monday.

"If they were so darn expensive, we wouldn't be seeing all of these deals. Despite all the grumbling about overvaluation, I think it is a very, very, very ... good sign," the "Mad Money" host said.

Cramer complimented all three of the aforementioned acquisitions, especially Schwab's, arguing that sometimes "these deals make so much sense that you've gotta wonder why they took so darn long."

He said he believes Tiffany will see improved sales numbers across the world once LVMH fully takes over the luxury jewelry brand.

Novartis, which is acquiring Medicines Company for $9.7 billion, is paying a price that is 340% higher than where Medicines was trading at the beginning of the year, Cramer noted. Yet the Swiss pharmaceutical giant still saw its stock rise more than 1% Monday.

Its decision to purchase the cholesterol drugmaker "fits in perfectly" with its "considerable heart franchise," Cramer said.

But beyond the recently announced deals, Cramer said, the market reaction makes him believe that further acquisitions could be on the horizon.

"And once you start seeing this kind of action, other businesses are encouraged to make deals, too. So you can expect more mergers going forward," Cramer said.

Among the areas he suggested could be ripe for consolidation: some underperforming retail operations, software companies that specifically deal with cybersecurity, and banks, particularly when it comes to smaller, regional players.

Financial technology companies, such as Square, could also be a natural place for acquisitions.

"We have too many payments companies," Cramer said.

While not all the potential consolidation would boast as much synergy as the Schwab-Ameritrade deal, for example, Cramer said he believes the possibilities are there.

"Some companies may be too big to be acquired, but there are thousands that aren't, and after today I'm tired of hearing how expensive these stocks are," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com