As the global pandemic enters its seventh month, millions of Americans lack health insurance.

According to research by the Economic Policy Institute published in late August and taking into account jobs gained back after the worst of the shutdowns during the spring, the coronavirus pandemic has left more than six million Americans without job-sponsored health insurance. When you take into account dependents, that number rises to more than 12 million.

"Though we don't yet know precisely how damaging the Covid-19 shock has been to health insurance access, the shock has laid bare the huge uncertainty that employer-linked health insurance introduces into U.S. families' lives. Even in normal times millions of U.S. households must manage coverage transitions in a given month. During economic crises, these coverage changes increasingly include transitioning into uninsured status, which puts families' health and financial security at risk," wrote Josh Bivens, author of the report and director of research at the Economic Policy Institute.

Job gains have slowed and many economists worry about more layoffs. Disney recently announced 28,000 additional job losses and airline employees remain in limbo as the talks over a federal stimulus package continue. Restaurants and other small business owners say that without more federal aid they will go under and be unable to bring workers back.

More from Invest in You:

Op-ed: Why financial planning improves your health

4 steps people can take to start building wealth, even in a recession

The costs of telehealth visits have shifted amid Covid-19

What to do if you lost health coverage

The first thing you'll want to do is talk to a human resources representative in your company to determine when your coverage will officially end. Coverage may end immediately or you might have until the end of the month, but there is no blanket rule.

Newly uninsured people will have three options to pick coverage: COBRA, the ACA marketplace or a public plan like Medicaid or Medicare.

You can also consult a local agent or assister near you to help navigate coverage options.

COBRA, or the Consolidated Omnibus Budget Reconciliation Act, allows for workers who worked for a company with at least 20 full-time employees and were enrolled under their employers' insurance for at least a day, to continue to pay their workplace insurance plan for a period of time. However, COBRA coverage is not available for people who lost coverage because their company went out of business.

An eligible person has 60 days to sign up for COBRA coverage. Keep in mind that there is no financial assistance from the government to help with premiums. This often makes COBRA unaffordable for those out of work.

For a lot of people, the Affordable Care Act (ACA) marketplace will provide cheaper options. Like COBRA you'll have 60 days to sign up from when you lose your coverage.

Some plans may still be too expensive for some. To figure out what you can afford, ask these questions:

- What is the maximum you can spend per month on a premium?

- Do you have any predictable health-care expenses?

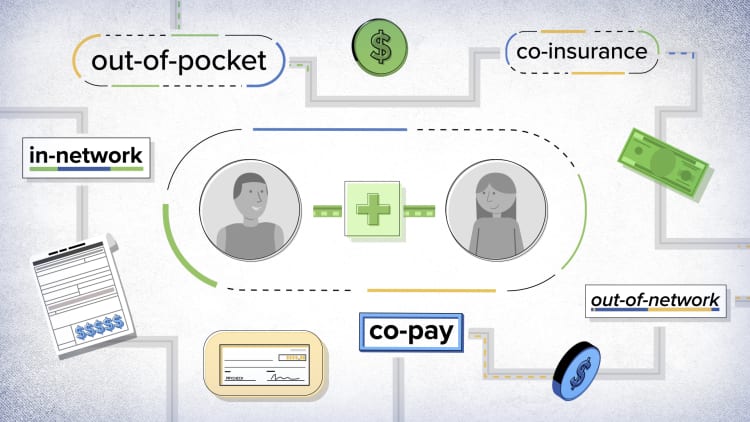

Evaluate how much a plan will cost and include co-pays, deductibles and co-insurance expenses.

The National Patient Advocate Foundation has a calculator to help you determine what your costs on the ACA marketplace will be.

Many out-of-work individuals will turn to Medicaid. Most Medicaid plans have zero premiums.

If you are over 65 and were on your employer's plan, now could be a good time to switch over and sign up for Medicare.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: How long $1 million would last you in retirement in the 3 most populous U.S. states via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.