Salvatore Reina owns three Francesca pizzerias in New Jersey that have been closed for indoor dining during the pandemic. While much of his industry turned to DoorDash, Reina resisted.

"Third parties take a big cut," said Reina, who opened his first pizzeria 12 years ago, about 20 miles outside of New York City. "I'd rather spend those marketing dollars to get people directly."

As DoorDash prepares for its public market debut, an offering that could value the delivery app service at over $30 billion, the San Francisco-based company has to show that it can make enough money on every order to turn into a profitable business. Meanwhile, investors have to consider how many restaurant owners will eventually turn away from apps like DoorDash because the costs are too high for their low-margin operations.

DoorDash charges a delivery fee to the consumer of a few dollars — and a commission to the restaurant that can reach 30% of an order. It's a hefty payout, but many restaurants made the decision to sacrifice profits during the pandemic instead of closing altogether.

Reina is willing to pay for software that helps bring business in the door and streamlines operations, but he wants to own the relationship with the customer. That includes having his own drivers rather than leaving delivery to outside contractors from DoorDash or Uber Eats.

"I don't like people I don't know handling our food," Reina said. "My staff and team work very hard to make the food nicely and prepare it properly. I don't want a stranger that I haven't vetted handling it."

While Reina is signed up with Doordash competitor GrubHub, he uses it only as a referral service, and doesn't use its delivery drivers. Reina said that after paying the 18.5% commission to GrubHub on an order that comes through the app, he makes sure to send his drivers out with coupons to spur customers to order direct in the future.

Different ways to compete

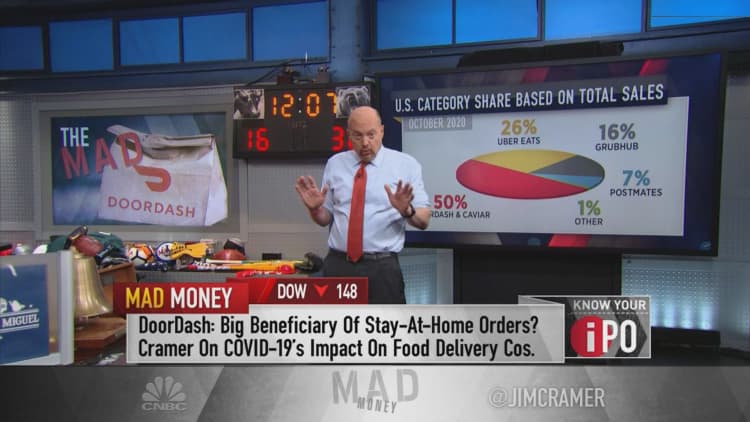

DoorDash is hitting the market with a massive tailwind. Through the first nine months of 2020, DoorDash's order volume climbed to $16.5 billion from $5.5 billion a year earlier, and it's the leader in food delivery, with about 50% of the U.S. market. Revenue jumped 268% in the third quarter from a year earlier to $879 million, following growth of 214% in the second period.

In its prospectus, DoorDash says that more than 390,000 merchants now use the app. What started as a short-term stopgap for many customers has become their primary revenue stream for the better part of 2020, as the Covid pandemic trapped customers at home and forced restaurants to close their dining rooms.

Much of DoorDash's Covid-era growth has come from restaurants that, unlike Francesca, didn't have their own drivers and needed a quick fix. Casual and upscale dinner spots were forced to sign on with third-party delivery apps as the only way to keep some revenue coming in the door while their actual doors were closed.

"Helping brick-and-mortar businesses compete, succeed, and flourish in these rapidly changing times is the core problem we are trying to solve," DoorDash says in its prospectus.

As the pandemic drags into its 10th month in the U.S., eateries are learning that they have other options — and not just competitors like Uber Eats and GrubHub. At Francesca, Reina uses technology from ChowNow, whose software allows him to take orders, create a mobile app and use data for marketing. He has also been testing Slice, whose technology targets independent pizzerias.

Both companies provide technology, including software and logistics, to help restaurants with delivery, but they don't supply the drivers. Both have their own apps that work like DoorDash, letting consumers view restaurants in their area and make orders. Restaurants choose how they want to handle the deliveries.

ChowNow offers a subscription that starts at $99 a month, along with a setup fee, and includes commission-free online ordering, menu uploading, marketing tools and customer support. It lets restaurants fulfill delivery orders themselves and integrates with DoorDash and local competitors, creating a bidding war of sorts that allows restaurants to pick the lowest-cost option.

"Restaurants need every dollar they can get wherever they can get it," said Chris Webb, CEO of ChowNow. Webb said ChowNow's order volume will climb fivefold this year to about $2.5 billion from $500 million in 2019.

Slice provides digital ordering services, marketing help and support, and charges $2.25 per order, instead of monthly fees.

Slice has seen similar growth in 2020 and is now working with 14,000 restaurants. To keep up with pandemic-fueled expansion, the company raised $43 million in May in a funding round led by KKR.

Slice CEO Ilir Sela says the key to maintaining long-term relationships with low-margin restaurants is to provide them with valuable services while not sucking up all the profit. For example, Slice uses its size to negotiate with pizza box distributors to lower the price of boxes for its network of local pizzerias.

Sela says the restaurants in his customer base are looking to piece together a model that allows them to satisfy customers' changing demands while staying viable.

"I believe in the next two to four years, there will be a massive movement of restaurants going direct to consumer," Sela said. In order to keep restaurants from jumping ship, Sela said, DoorDash would have to drop its commissions, which would be a challenge when dealing with Wall Street.

No moat, no loyalty

DoorDash reported a net loss of $149 million through the first three quarters of this year, narrowing its deficit from $533 million a year earlier. The company finally started turning a profit on an average order, recording a so-called contribution margin of 23% through September, compared with a negative margin of 32% a year earlier.

Investment research firm New Constructs says DoorDash has made it to the IPO stage only because of "the overblown fervor of the work-from-home theme."

One main problem, New Constructs said in a report last week, is that DoorDash has "no moat" and that customers have no loyalty to the service. The firm said that, based on its analysis, the percentage of DoorDash customers who use the app exclusively fell to 53% in the third quarter of 2020 from 63% in the same period a year earlier.

Consumers want to pay lower fees, and restaurants are always looking to reduce costs. Cutting out middlemen is the easiest way to accomplish that. The next best method is to find cheaper alternatives.

"You don't have to be a business expert to understand that businesses without differentiated offerings struggle to charge prices above the cost of the service," New Constructs said. "In other words, they never turn a profit."

DoorDash didn't provide a comment for this story.

WATCH: Jim Cramer breaks down DoorDash IPO, recommends purchase price