Instacart filed an updated IPO prospectus Monday and clarified how its contract works with data storage and analytics company Snowflake, after the initial filing appeared to show a dramatic decline in spending on Snowflake's technology.

Snowflake CEO Frank Slootman is an Instacart board member, a relationship that requires the grocery delivery company to disclose details of the business ties between the companies.

The original prospectus showed that Instacart's payments for Snowflake's "cloud-based data warehousing services" jumped from $28 million in 2021 to $51 million in 2022, but were expected to drop to $15 million this year. The apparent slippage led to confusion and spurred employees at rival Databricks to suggest online that it was picking up that business.

Snowflake published a four-paragraph blog post explaining that the numbers were being misconstrued and that in this case, payment doesn't equal usage because of how the contract is written. Instacart spelled out how that contract works in Monday's filing.

"These cash payments, including the payments we made in 2022, generally represent prepayments for future services which, in many cases, span multiple fiscal periods," Instacart wrote. "As such, these payments are not indicative of actual cloud-based data warehousing services provided to and used by us in the period in which any such payment is made, as the expenses related to usage are recognized over time as services are provided to us."

To understand usage of the technology, the best number to look at is operating expenses. For both 2021 and 2022, Instacart said it incurred operating expenses tied to the cloud technology of $28 million.

However, in order to see where that number stands in 2023, an investor would still have to reference a footnote much later in the filing. There, Instacart says that in the first half of the year it incurred $11 million in operating expenses for use of Snowflake's technology. On an annualized basis, that would still suggest a drop of 21%.

In Snowflake's Aug. 30 blog post, the company says it's helping Instacart "optimize for efficiency," a phrase that implies doing more with less. While that may explain some or all of the drop, it's also true that Instacart has been pushing more business to Databricks, particularly for its advertising infrastructure.

Instacart isn't required to disclose its relationship with Databricks, but both companies published recent posts about the implementation on their websites. They deleted those posts shortly after Instacart's initial filing.

Snowflake shares rose 2.2% on Monday, lifting its market cap to $55.9 billion. Databricks is still private and was last valued in at $38 billion in 2021.

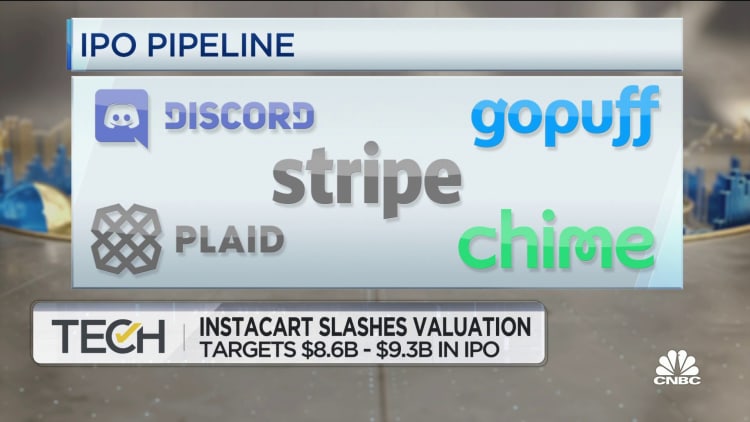

Instacart also said in the update that it's seeking to sell shares in the initial public offering for $26 to $28, which would value the company at as much as $9.3 billion. That's a steep drop from its peak private market valuation of $39 billion and shows what may be required in order to go public in an IPO market that hasn't seen a notable venture-backed offering since December 2021.

WATCH: Instacart slashes valuation