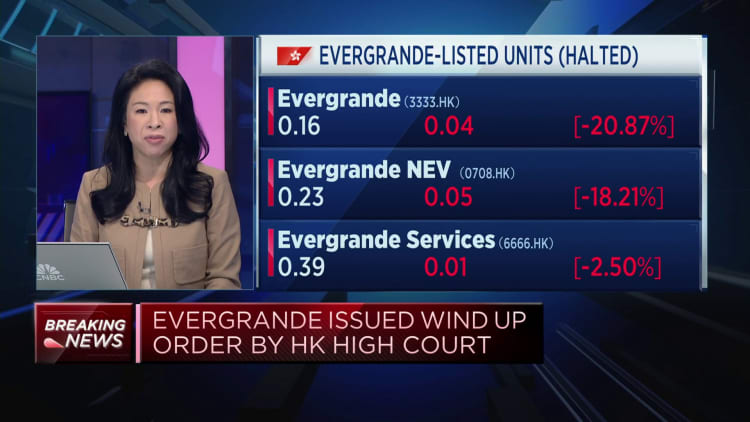

Shares of China Evergrande were halted after plunging more than 20% in early trading Monday after a Hong Kong court ruled to liquidate the embattled property developer.

It comes against the backdrop of a spiraling debt crisis in the country.

China Evergrande, which was once one of the country's largest property developers, has in the last few years been enveloped in Beijing's debt crisis.

The Wall Street Journal earlier reported that Evergrande's overseas creditors failed to reach an 11th-hour deal this weekend to restructure, which could mean imminent liquidation for the real estate developer.

Evergrande is the world's most indebted property developer, which defaulted in 2021 and announced an offshore debt restructuring program in March last year.

Containing the contagion

Policymakers in China have been scrambling to stem the debt crisis in the beleaguered property sector.

Last week, China's central bank and the Ministry of Finance announced measures to help boost the liquidity available to property developers.

The actions, which will be valid until end of this year, will help ease a lingering cash crunch for Chinese developers after Beijing cracked down on the sector to address bloated debt levels in real estate.

The property sector in China still remains challenging against the backdrop of the Evergrande news, according to Alexander Cousley, APAC investment strategist at Russell Investments.

"I think the measures have to be much more targeted and much more forceful," Cousley said on CNBC's "Street Signs Asia."

Evergrande's crisis set off contagion fears that China's property sector troubles could spill over to other parts of the world's second-largest economy.

Country Garden, also one of China's largest developers, has been struggling to pay off its own debt. However, the developer reportedly said last month that it may avoid a default on its yuan-denominated bonds.