European markets closed slightly lower Monday as investors digested the latest comments from U.S. Federal Reserve Chairman Jerome Powell.

European markets

The pan-European Stoxx 600 provisionally closed 0.14% lower, having shifted either side of the flatline during morning trade. Retail stocks were down 2.2%, while food and beverage stocks rose 1.1%.

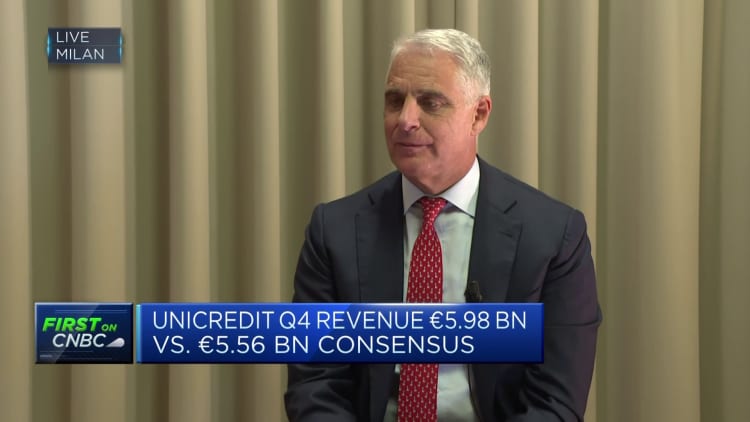

Shares of Unicredit hit their highest level since 2015, finishing the session up over 8%, after the Italian bank announced that it would return 8.6 billion euros ($9.2 billion) to investors on the back of higher-than-expected profits.

In an interview with CBS' "60 Minutes" on Sunday, Powell said the central bank would likely move at a considerably slower pace on rate cuts than the market expects.

Asia markets kickstarted their week largely lower after Powell's comments. U.S. stocks also retreated in morning trade.