Consumers have been increasingly relying on credit cards to make ends meet, and it may be finally catching up with them.

The national average credit score, which has steadily increased over the last decade, fell to 717 from a high of 718 in the beginning of 2023, according to a report from FICO, developer of one of the scores most widely used by lenders. FICO scores range between 300 and 850.

"It's a notable milestone," said Ethan Dornhelm, FICO's vice president of scores and predictive analytics. "This is the first time in well over a decade that the score went down."

Average nationwide credit scores bottomed out at 686 during the housing crisis more than a decade ago, when there was a sharp increase in foreclosures. They steadily ticked higher until the Covid-19 pandemic, when government stimulus programs and a spike in household saving helped scores jump to a historic high in April 2023.

Consumers are falling deeper in debt

High interest rates and higher prices have weighed on most Americans' financial standing. Consumers as a whole are falling deeper into debt, causing an increase in credit card balances and an uptick in missed payments, FICO found.

As of October, the average credit card utilization was 35%, up from 33% a year earlier, and just over 18% of borrowers had a more than 30-day past-due missed payment against their credit accounts, up from 16.5% the year before.

"Another likely driver is that savings rates have trended back down to zero and those savings cushions that many consumers had have disappeared," Dornhelm said.

More from Personal Finance:

Average credit card balances jump 10% to a record $6,360

Credit card debt hits a 'staggering' $1.13 trillion

Americans can't pay an unexpected $1,000 expense

During the pandemic, most Americans benefited from a few government-supplied safety nets, including the large injection of stimulus money. That left many households sitting on a stockpile of cash that enabled some cardholders to keep their credit card balances in check.

But that cash reserve is largely gone after consumers gradually spent down their excess savings.

"We are pretty far removed from pandemic-level mitigation programs, so consumers are very much confronted with making good on their credit obligations with little in the way of stimulus checks or government defined accommodation programs," Dornhelm said.

What is a 'good' credit score?

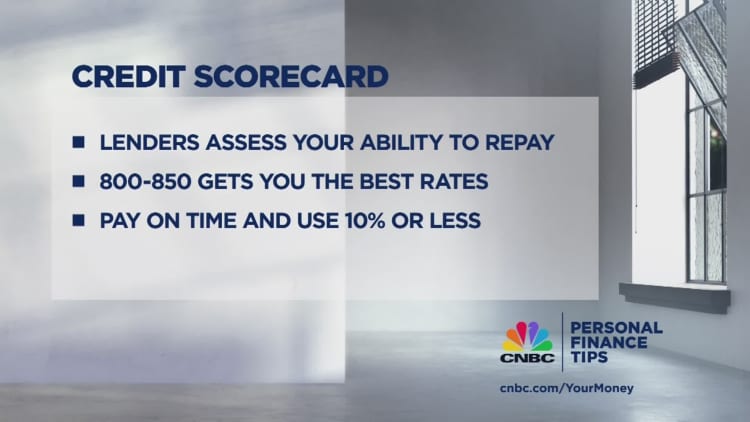

Generally speaking, the higher your credit score, the better off you are when it comes to getting a loan. You're more likely to be approved, and if you're approved, you can qualify for a lower interest rate.

Alternatively, "the lower the credit score the less likely you could get approved for financing and the higher your interest rate is going to be," said Ann Kaplan, founder of iFinance, based in Toronto, Canada.

Already, the average credit card charges over 20%, a record high, but borrowers with lower credit scores pay even more. "It's difficult in this current economy not to have a good credit score," Kaplan said.

A good score generally is above 670, a very good score is over 740 and anything above 800 is considered exceptional.

An average score of 717 by FICO measurements means most lenders will consider your creditworthiness "good" and are more likely to extend lower rates.

Some of the best ways to improve your credit score come down to paying your bills on time every month and keeping your utilization rate, or the ratio of debt to total credit, below 30% to limit the effect that high balances can have, Kaplan said.

Don't miss these stories from CNBC PRO:

- Instead of chasing Nvidia, investor buys these misunderstood, cheap growth stocks for big returns

- Why Warren Buffett thinks the power of compound interest is the key to his success

- Forget cash — it's time to move into fixed income, Franklin Templeton strategist says

- Dan Niles reveals why he prefers the 'Fantastic Four' and when the 'AI bubble' might pop

- Investors should tread carefully in March after bitcoin's explosive rally to $60,000