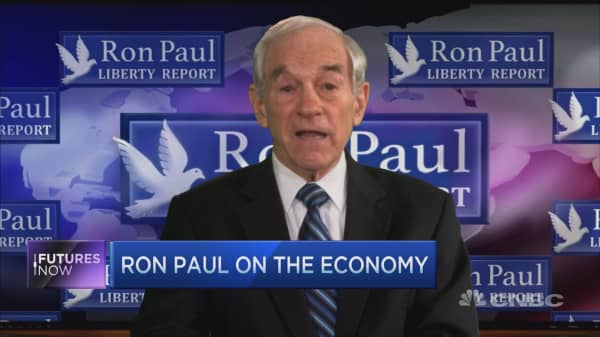

Ron Paul wants to deliver a message to the market that he claims the Federal Reserve refuses to do itself.

The former U.S. Republican congressman said this week that the Fed has been propping up markets, and the U.S. economy has already entered a recession despite what central bankers might say.

"They're paid to spin it in a positive manner," the libertarian firebrand told CNBC's "Futures Now" in an interview.

He added: "You can't expect them to say anything else."