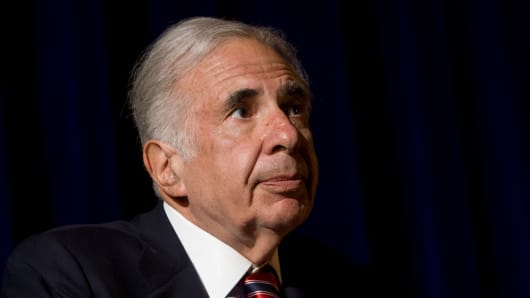

Details of the discussions could not be learned. Icahn's persistence underscores why in many boardrooms he is still regarded as one of the most feared activist investors.

He has been highly critical of Forest leadership in recent years, arguing that the company in which he holds an 11.5 percent stake has been badly managed and underperforms industry peers.

Icahn has criticized the U.S. drugmaker for being ill-prepared to generate future growth in the face of looming generic competition for two of its biggest selling products—the antidepressant Lexapro and the Alzheimer's treatment Namenda—and for numerous warnings the company received from U.S. health regulators related to marketing practices of its drugs.

(Read More: Icahn,Ackman in Epic Showdown of Billionaires)

His campaign against the company has met with limited success. Last year's proxy battle, for example, ended with just one of Icahn's four nominees being elected to the board—Pierre Legault, the former chief financial officer of OSI Pharma.

Legault has since distanced himself from Icahn, telling people that he didn't know the investor well and wasn't "his guy," one of the sources said.

Legault declined to comment.

Forest has also been taking steps that would blunt some of that criticism. The company has launched new products over the past two years. The company's share price is up about 18 percent since last August, beating the 14 percent gain for the broader S&P 500 over that time period.

Icahn had also accused the Forest CEO of planning to install his son as his successor without a proper review of potential candidates for the top post.

That challenge may have been eclipsed by recent events. In May, Forest said Solomon would retire at the end of the year after more than 35 years of running the U.S. drugmaker. It said an independent committee from the board was evaluating internal and external candidates for the top job. Solomon was to remain chairman and would be a candidate to retain his seat on the board.

(Read More: Icahn in Proxy Battle Over Dell)

One potential CEO candidate could be Bausch & Lomb Chief Executive Brent Saunders, who is on Forest's board. The sources said it was still too early in the CEO search process to know if he would be a candidate.

Saunders declined to comment.

Saunders, a highly regarded executive with turnaround expertise, is expected to leave the eye care maker following a transition period once its recently announced acquisition by Valeant Pharmaceuticals International is completed.

That could take place as early as this summer, a person familiar with the proceedings said, leaving the former Schering-Plough executive a sizeable window to help with the transition before Solomon steps down.