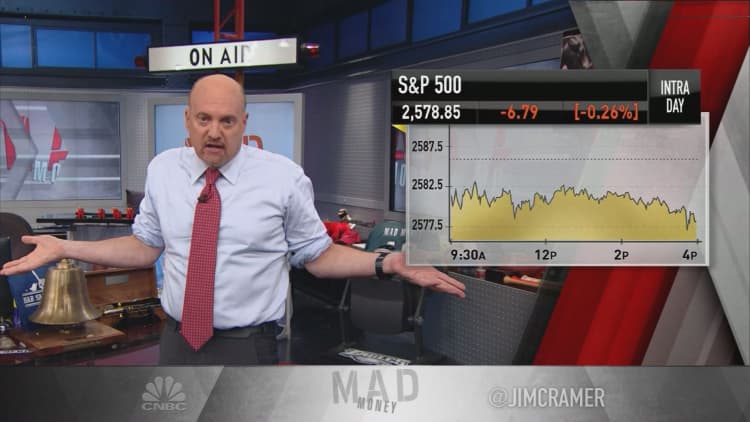

As stocks drifted down from their highs on Friday, CNBC's Jim Cramer urged investors not to blame earnings action for the market's failure to rally.

"Even the amazing numbers and the stock moves from Foot Locker, from Ross Stores, from Gap, even from Abercrombie & Fitch, they weren't enough to prop up the averages," the "Mad Money" host said. "But no one ever said the stock market had to be rational, and in fact, market irrationality often gives us exactly the kinds of great opportunities I talk about because we can try to make money by going against the grain."

Cramer said a lot of the market's moves have been mirroring overseas markets, a trend he called "stupidity" because foreign stocks often slide on a weakening dollar, which is a boon for U.S. companies.

"That said, while blowout earnings reports can't always save the broader market, a beat-and-raise quarter will almost always produce higher prices for the stock in question," Cramer said. "It's another reason why you have to pay attention to the individual earnings reports."

With that in mind, Cramer turned to the stocks and events he'll be watching next week:

Monday: Agilent Technologies, Urban Outfitters, Palo Alto Networks

Agilent: Agilent reports earnings after Monday's closing bell, and Cramer has been amazed by this technology equipment testing company's repeated upside surprises.

"It's remarkable how consistent this company is, and the stock hit a new high today. I would not be surprised if it's got more room to run," he said.

Urban Outfitters: Shares of Urban Outfitters have been roaring ahead of its Monday earnings announcement, presenting an interesting dilemma: Can this retailer's stock continue to run after its report?

"I actually think the answer could be yes," Cramer said. "Look at Children's Place. That said, the recent retail rally relies heavily on short-covering, which means when the shorts are finished re-positioning, it's likely to run out of steam. So I'm going to take a pass on Urban Outfitters."

Palo Alto: Cramer was concerned about this cybersecurity play ahead of its report. Though Palo Alto's last quarter was strong, the "Mad Money" host worried that Cisco's security arm could be taking market share from Palo Alto.

"While I think the world of Palo Alto's CEO, Mark McLaughlin, I want to watch this one and wait here, mainly because the stock was up so big today," he said.

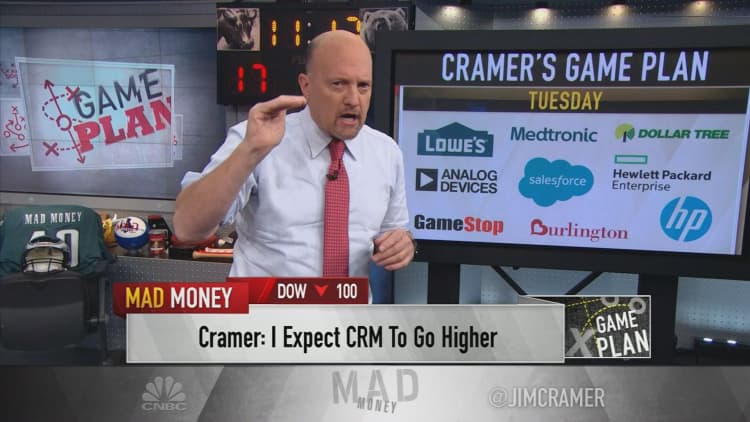

Tuesday: Lowe's Companies, Salesforce.com, Hewlett Packard Enterprise, GameStop

Lowe's: Even though Lowe's has had some strong earnings results of late, Cramer didn't want to recommend the retailer's stock ahead of its report.

"I don't believe Lowe's is performing at the level of Home Depot, and I think the Home Despot didn't get nearly the credit it deserved after reporting its blowout quarter. So why take a chance with the likely inferior Lowe's?" he said.

Salesforce: Shares of this Cramer-fave cloud play have run ahead of its Tuesday earnings report, but the "Mad Money" host still excepted a big quarter.

"Every year I go to Dreamforce in San Francisco, that's their tech festival, and each time I'm blown away by all the new clients and all the business they're doing around the world. I think Salesforce goes higher, as CEO Marc Benioff just keeps winning contract after contract, but please don't buy the first tick of the trade if it's up," Cramer said.

HPE: Cramer felt "uneasy" about Hewlett Packard Enterprise ahead of the tech company's earnings report on Tuesday because of its cohort of competitors.

"I'm as negative on it as I am positive about HP. That's the one that's got the PC and the printers, and it continually blown away the numbers," he said. "That thing's been a total beast and beasts tend to keep running."

GameStop: Having spoken to an array of gaming companies and CEOs, Cramer was especially worried about this video game retailer's earnings report.

"The digital world has really taken over," he said. "I think there's just not enough brick-and-mortar business left for GameStop to make a real go of it."

Wednesday: Deere & Company, durable goods orders

Deere: With agricultural stocks in the midst of a powerful up-cycle, Cramer expected a strong earnings report from agricultural equipment play Deere. Shares of the company have been flying high, but Cramer said it could be a buy before and after earnings.

Durable goods: Cramer also anticipated strong data about U.S. durable goods orders from the Commerce Department. The results will shine a light on whether the economy is strong enough for a December rate hike.

"I think the answer is yes, we have good, strong numbers, but we know from the last two weeks of selling that we're hearing a lot of commentary about short rates shooting up while long rates are flat. That's a condition that's often been a precursor to a recession. I don't believe we will get one this time, but I'm not above looking at the data to challenge my thesis," the "Mad Money" host said.

Final Thoughts

"Here's the bottom line: there are a lot of great earnings reports coming early next week, so pay attention before everyone goes away for Thanksgiving," Cramer concluded.

WATCH: In Cramer's weekly game plan, don't blame earnings

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com