There's never a good time for a trade war, but for Canada the announcement of possible tariffs on steel and aluminum imports comes at a particularly difficult moment for the country.

The Great White North is currently engaged in what's become a bitter battle over NAFTA's future, and it was announced Friday that its GDP grew at 1.7 percent in the fourth quarter, much slower than the 4 percent it was growing at previously. Its stock market is down about 5 percent year-to-date and was flat over the last 12 months.

On Monday, Trump tweeted that his hasty announcement may not be implemented for Canada and Mexico if a fair NAFTA agreement is negotiated. Canadian market watchers are hoping this will be the case.

After aerospace-related trade flare-ups, fights over softwood lumber and President Donald Trump's continuous verbal jabs at the country, the last thing Canada needs now is to get into another cross-border brawl.

"Canada seems to get kicked when they're down," said Barry Schwartz, vice president and chief investment officer at Baskin Financial Services, a Toronto-based wealth management firm. "We're dealing with so many things at the same time, and Canada hasn't even done anything wrong."

The hit on Canada's economy

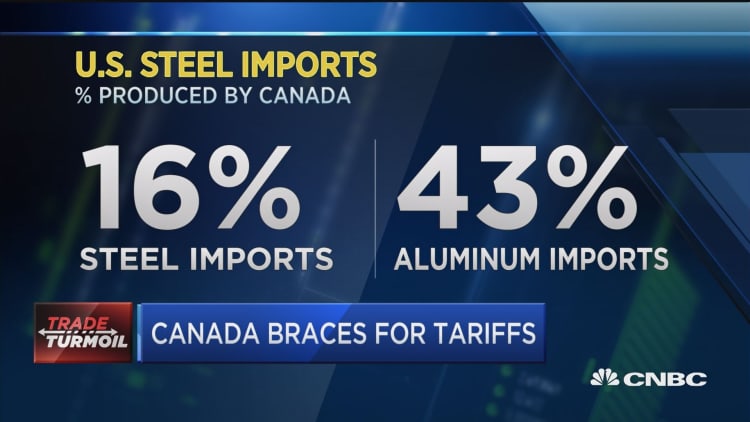

Imports on tariffs could hit the country particularly hard. Canada exports nearly 90 percent of its steel to the United States, while it accounts for 16 percent of all U.S. steel imports, the most out of any country. It also accounts for 41 percent of America's aluminum imports. Trump's main target in this, China, barely exports any steel to the United States, with America ranking 26th as a destination for Chinese steel imports, according to the International Trade Administration.

While there aren't publicly listed steel and aluminum companies in Canada of any significance anymore — they were all bought in the mid-2000s by larger international concerns when demand for commodities from China was soaring — putting a 25 percent tariff on steel and 10 percent tariff on aluminum should make goods in other sectors, such as auto, defense and aerospace, more expensive to produce and pricier to buy. If that happens, then people and companies may spend less in other areas, which could then impact a number of sectors.

"Resources will be shifted toward these two sectors and away from everything else," said John Curtis, a senior fellow at the C.D. Howe Institute and the founding chief economist at what used to be Canada's Department of Foreign Affairs and International Trade. "That means people will have to pay more, so they'll buy less of everything else in the economy."

Where a steel tariff might have the most impact, though, is on Canada and America's interconnected supply chain, of which many companies big and small are a part of, Curtis said. For instance, cars assembled in Canada have parts made in the United States and vice versa. Cars are often being shipped back and forth between the two countries until final assembly.

"Parts move back and forth until it might finally get made in Canada," said Patrick Leblond, a senior fellow the Ottawa's Centre For International Governance Innovation. "Then that car will get exported back to the U.S. Is there going to be tax every time that happens?"

Trade war worries

Steel and aluminum tariffs should be worrisome for companies and investors alike, but the big question that everyone has on their minds now is, what does this mean for NAFTA?

That question likely won't be answered anytime soon. In a tweet Monday morning, Trump called out Canada: "We have large trade deficits with Mexico and Canada. NAFTA, which is under renegotiation right now, has been a bad deal for U.S.A. Massive relocation of companies & jobs. Tariffs on Steel and Aluminum will only come off if new & fair NAFTA agreement is signed. Also, Canada must treat our farmers much better."

Threatening to remove tariffs only if the administration gets what it thinks is a good deal from NAFTA surely won't go over well with Canada and Mexico. (And the United States has a trade surplus with Canada, not a deficit, according to the Office of the United States Trade Representative.)

Still, Leblond doesn't think these tariffs will impact discussions, as negotiators likely are focused more on technical and legal issues right now than steel. Also, when the U.S. slapped a 20.8 percent tariff on Canadian lumber producers for softwood lumber imports, NAFTA talks kept going. (Canada did take its fight with the United States to the World Trade Organization, though.)

However, it certainly doesn't help things, Curtis said, and could make negotiations much more awkward and tense. Canadian foreign minister Chrystia Freeland, who is part of the negotiating team, said sternly that these tariffs were "absolutely unacceptable" and that Canada is prepared to "take responsive measures to defend its trade interests and workers."

Prime Minister Justin Trudeau echoed Freeland's comments, adding that "any disruption to this integrated market would be significant and serious."

Some market analysts do foresee a grave threat to NAFTA in Trump's tariff move. But if Canada and other countries do indeed retaliate with tariffs of their own and a trade war begins in earnest, then whether NAFTA stays or goes could ultimately be of lesser importance. It could upend global trade as we know it, Leblond said. He's particularly concerned about Trump using a national security excuse to impose tariffs.

Avery Shenfeld, chief economist at CIBC Capital Markets, said it's a double-edged sword in terms of the NAFTA negotiations. Unless Canada gains an exemption, a war of words and actions on trade isn't a helpful backdrop for reasoned negotiations. But it also helps satisfy Trump's protectionist voting bloc, perhaps easing the pressure on the White House to take a hard line on the NAFTA deal.

These sorts of disputes underscore why Canada believes that the appeal process under NAFTA is a critical piece of the puzzle. The Trump administration wants a deal that excludes that provision, but without it Canada can face spurious rulings against its exports even with a "free trade" agreement in force, Shenfeld said. "The latest claim, that U.S. national security is imperiled by the use of Canadian steel or aluminum in U.S. manufacturing, seems baseless, considering that Canada has been America's steadfast ally," he said.

"If everyone can now say we're going to impose tariffs because we need to protect what's important and use national security as a justification, then everyone will lose," Leblond said. "[Canada] could put a ban on California wine; China could impose constraints on intellectual property rights or innovation. The fear is that it will undermine the WTO process, and for what? To protect a small portion of U.S. manufacturing jobs?"

Sagging stocks

While things could change between now and April 11, when Trump will decide whether to impose the steel tariff, and April 19, when he must make a decision on aluminum tariffs, stocks have taken a hit from the announcement.

The S&P/TSX Composite Index representing Canadian stocks hasn't been hit as hard as the S&P 500 — the market is almost flat now since the announcement — but some companies have seen their share prices decline more significantly. Global auto parts supplier Magna, for example, is down 3.9 percent and shares of aerospace giant Bombardier fell by nearly 6 percent when the markets opened Friday but have regained some ground since.

More from Global Investing Hot Spots:

If Trump thinks he's taking a trade war to China, he's not

Italy's far right is a big fan of Trump's tariffs

Risky retirement investors reaching for income in foreign bonds

Jeff Mills, managing director and co-chief investment strategist at Pittsburgh-based PNC Asset Management Group, isn't surprised that stocks in the United States and elsewhere are selling off post-announcement, though U.S. stock did rebound on Friday afternoon.

"The policy change will very likely increase costs for all consumers, which means it will serve to reduce some of the benefit of the recently passed tax bill," he said. "Markets are now worried about countermeasures from other countries, and investors are starting to wonder what other protectionist measures Trump could take."

Baskin Financial's Schwartz doesn't think the Canadian stock market will take that much of a hit over these tariffs specially — the S&P/TSX is already underperforming other markets – but if a trade war heats up then stocks in Canada and around the globe will see big declines.

"Who knows what will happen, but I presume the direction would be negative," he said. "The price of goods for everything around the world would go up, inflation would rise, and while companies ultimately adjust to inflation, stocks will be negative while that adjustment period happens."

Global investors can't do much now, added Mills, as the exact details are still largely unknown, though he does think, generally, people should be making sure they're comfortable with the risk they're taking in their portfolios. Any investors interested in Canada, though, should hope that Trump, at the very least, makes the country tariff-exempt.

"Canada is probably the most penalized as things stand today," Mills said. "Perhaps cooler heads prevail over the weekend and the tariffs end up being less broad-based."

WATCH: Former ambassador on US-Canada relationship

— By Bryan Borzykowski, special to CNBC.com