Apple shares gained almost 6 percent Wednesday after a strong fiscal third-quarter report, but ended trading shy of a highly anticipated $1 trillion market value.

The stock closed at $201.50, just below the intraday high of $201.76. Shareholders had previously been looking for a price of $203.45 to make Apple the first publicly traded U.S. company worth $1 trillion — though the tech giant announced an adjusted outstanding share count later Wednesday that moved the threshold to $207.05.

The iPhone maker slightly missed Wall Street forecasts for sales of the flagship handset, but surpassed estimates for average selling price. It also beat on earnings per share and revenue from the growing software and services segment.

Wall Street was largely bullish on the report, which many saw as Apple staying the course. Analysts at Morgan Stanley and RBC Capital both noted Apple is steadily on its way to $1 trillion.

"Apple's narrative is shifting towards their ability to sustain mid-single digit sales growth despite flat iPhone units and low-to-mid teens EPS growth via buybacks," RBC analysts wrote in a note. "Hit Snooze for 90 Days. Path to Trillion Intact."

As of Wednesday's close, Apple has gained 19 percent in 2018 and 34 percent in the last 12 months.

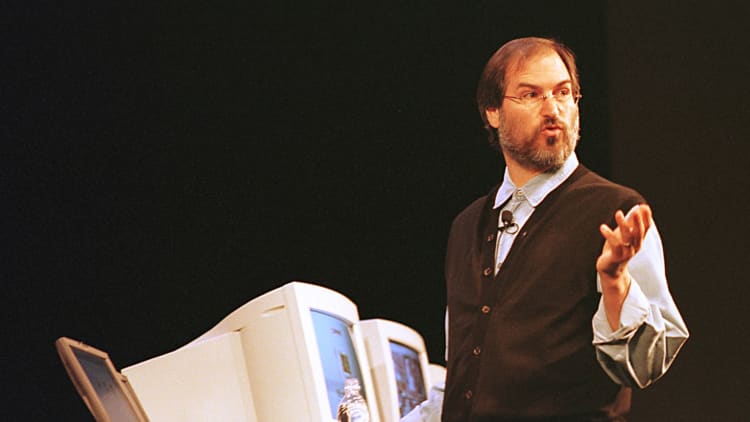

WATCH: Steve Jobs defends his commitment to Apple on CNBC in 1997

— CNBC's Ariel Shapiro contributed to this report.

Correction: Apple could become the first publicly traded U.S. company worth $1 trillion. An earlier version mischaracterized its status.