Kevin O'Leary knows when he likes an investment, and the current beaten-up stock market meets his requirements. On Wednesday, when both the Dow Jones Industrial Average and S&P 500 saw 2018 gains wiped out, and the pummeling in the tech stocks left the Nasdaq down 8 percent for October, O'Leary was buying.

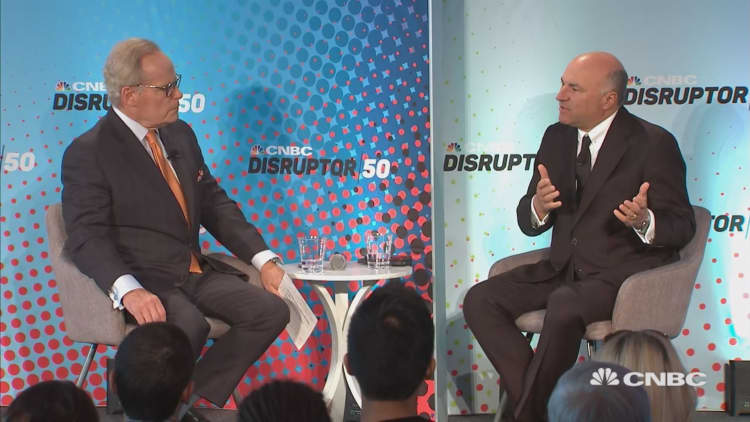

"I am bullish on the American economy and this too will resolve itself," O'Leary, the Canadian entrepreneur and "Shark Tank" star, said at the CNBC Disruptor 50 Roadshow in Philadelphia on Wednesday afternoon. "To me, this is a garden variety correction, could correct as much as 22 to 25 percent, and if you can time the market, great, but I am just adding to my positions. I did again today."

Channeling his best Warren Buffett "be greedy when others are fearful" quote about when to buy more stocks, and what he sees right now as the "blood on the streets" mentality that can wrongly grip investors, O'Leary added, "Everyone is saying it is over, never going up again .. I'm starting to get that feeling now, and I like it."

O'Leary on what causes corrections

The entrepreneur said a historical view of the S&P 500 explains why this correction is happening: the Fed.

During almost every period when the Fed begins to tighten by raising rates — even when there are different reasons for the shift in interest rate policy — the market corrects for at least nine months. He said in these periods, investors don't know if the Fed is tightening because of enhanced pricing power and enhanced profits and high cash flows that will be coming to corporate coffers, or for more negative reasons.

O'Leary's travels as an entrepreneur funding start-ups across the U.S. gives him a more positive view of the situation.

"We are having our best quarter ever, ever," he said.

O'Leary stressed that there are big differences between the small companies he is funding and the stock market, and he is most bullish on new business formation. For one, the market is primarily large-cap companies where 40 percent of revenue comes from foreign markets. That is not an issue his cupcake company has to worry about. "It doesn't sell to China and is having its best quarter ever," he said.

He also said the current Trump administration's regulatory relaxations and tax code changes — which many small enterprises have yet to digest let alone benefit from — make it a great time to start a company in America.

"So yeah, markets go down, but it doesn't matter because at the end of the day, I ... place bets in lots of places."