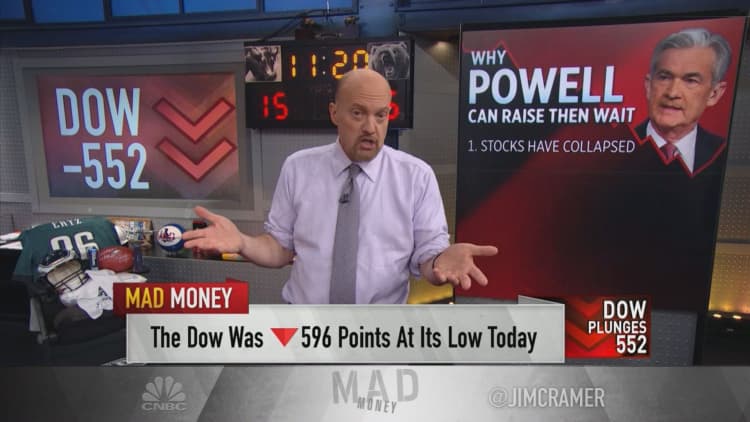

Federal Reserve Chair Jerome Powell is now equipped to pause the central bank's interest rate hike agenda after December thanks to this debilitating sell-off, CNBC's Jim Cramer said Tuesday.

"Today's sell-off gives Fed Chief Jay Powell the cover he needs to raise interest rates one more time next month and then put the next few hikes on hold," said the "Mad Money" host, who supports the widely anticipated December hike.

Cramer came up with eight reasons for the Fed to stop its plans, which the Federal Open Market Committee has suggested will include three more hikes over the course of 2019. Cramer has warned that raising interest rates in lockstep could derail U.S. economic growth.

1. Stocks are collapsing

The action in FAANG, Cramer's extended acronym for the stocks of Facebook, Apple, Amazon, Netflix and Google, now Alphabet, is a prime example of the weakness in the stock market, he said. Collectively, the five companies have lost over $1 trillion in value from their 52-week highs.

"What does all of this have to do with the Fed? Simple: it's called the wealth effect," Cramer said. "When your investments lose value, people feel poorer, and that causes them to spend less money."

2. Oil is cratering

Oil prices have plunged, with U.S. crude at its lowest level since October 2017 as commodity investors grow increasingly concerned about a slowing global economy and supply gluts.

"That's called deflation. It's an extraordinary boon to the consumer. It puts the Fed's biggest worry in check. I have to believe the price at the pump is going to come down and come down hard over the next few weeks," Cramer said. "For now, let's say it wouldn't shock me if crude goes to the high $40s."

3. Retail stocks are falling

Widespread weakness in the retail sector is signaling an impending slowdown, Cramer said. The action in the retail stocks alone was enough to make him wonder if the Fed even needs to raise rates in December.

"Here's the issue: the retail stocks can't all be wrong," he said, brushing off retail executives' rhetoric about 2018 being the best holiday season in history. "If the Fed ignores them, that would be insanely rash. Remember, the retailers took down a lot of inventory ahead of the tariffs on China. What happens if they can't sell it all? Lower consumer prices, that's what."

4. Housing is 'awful'

Cramer called the housing space "downright awful" after hearing the Mortgage Bankers Association's forecaster say that single-family housing starts had their slowest pace of growth in four months and the worst year-over-year decline since 2015.

"We know affordability has hurt the calculus. With mortgage rates climbing to 5 percent, refinancing is at an 18-year low," he said, doubling down on earlier remarks. "Housing declines can cause an awful lot of layoffs as the homebuilders realize that the market isn't coming back any time soon."

5. Hotels are struggling

For the first time in more than eight years, "our hotels' collective revenues per room fell last month," Cramer warned.

"That's a sit-up-and-take notice figure from a segment of the economy that's been very strong," he said.

6. Tariffs are hurting

The trade war is putting pressure on the system, and if the United States' tariffs on Chinese imports rise from 10 percent to 25 percent at the end of the year as planned, "there's going to be a lot of pain and stress" in the U.S. economy, Cramer said.

7. Data turning negative

Last month, the country's largest power transmission company, American Electric Power, said that "the mix of growth has started to shift" in the United States. On a conference call, management said that, in the first half of 2018, growth was "balanced across most industries," but that third-quarter growth was "dominated by the oil and gas sectors while the remaining sectors moderated."

"Oil was driving things in the third quarter," Cramer said. "Well, what happens to a commodity that just lost 24 percent of its value in the last month?"

8. Auto demand is slowing

Slowing auto sales give the Fed yet another reason to reconsider its hawkish plans for 2019, the "Mad Money" host said.

"The average car on the road in America is now 11.2 years old. Cars last longer than they used to, so the demand for new ones continues to slow. Even used car values fell by 1 percent last month," he said.

Final thoughts

Cramer still figured that one rate hike in December wouldn't throw the U.S. economy into a slowdown given the country's positive employment trends.

"Bottom line? Next year, when we annualize the tax cuts, when the tariffs rise to 25 percent, when the retail and housing layoffs begin in earnest, ... and if Powell keeps raising rates, well, we're not going to want to own a lot of stocks," he said, calling back to comments he made on "Squawk on the Street."

"The worse things get, the more likely it is that the Fed will do the right thing, though. That's the one silver lining today," he continued. "Still, let's hope Powell sees the light soon, or else these declines could get — I admit — even nastier."

WATCH: Cramer's 8 reasons for the Fed to pause its rate hikes

Disclosure: Cramer's charitable trust owns shares of Facebook, Apple, Amazon and Alphabet.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com