If you have to choose a ridesharing executive to listen to on the future of human drivers as robo-taxis rise, take controversial former Uber CEO Travis Kalanick over the current management of both Uber and Lyft, who are careful these days talking about the timeline for AI replacing human and steering wheel, or even suggesting that there may one day not be any role for human drivers.

Those drivers striked this week against Uber ahead of its IPO, Lyft shares continue to tank since going public, and uncertainty over driver economics and work status is a big social issue. But one thing Kalanick was sure of as far back as 2014, and was not afraid to say, was that the driverless future was coming and drivers would be out of luck.

"'Look, this is the way the world is going,'" Kalanick, speaking at the 2014 Code Conference, said would be his explanation to Uber drivers who might lose their jobs down the road. "If Uber doesn't go there, it's not going to exist either way. The world isn't always great."

Lyft, concurrent with its first earnings report this week — after which investors kept selling — announced a deal with Waymo, Alphabet's self-driving car effort which for years was engaged in litigation with Uber.

As Tesla has struggled to find a roadmap to profitability actually making cars, Elon Musk has started talking up his company as a potential $500 billion market winner based on Teslas being turned into robo-taxis by their owners. Musk said his electric-car company should have 1 million vehicles capable of functioning as robo-taxis on the road next year and that owners of the cars should be able to generate tens of thousands of dollars from them annually (while he has accomplished a great deal, Musk is not known for his predictions coming true on schedule).

The public often focuses on the risks of autonomous driving — fatalities involving both Teslas and an Uber test car have unsettled many. But the economics of self-driving technology will play as big a part in determining the winners of the driverless future. The race already is on and, according to Intel's top autonomous-driving executive, the race will focus on a drastic reduction in cost associated with today's human driver-based economics.

The driver today is 80% of the economics. Once you remove the driver and you replace it with capex — the cost of the car, the cost of the technology, and you can, you can have the cost of technology for a few tens of thousands of dollars ... it is game-changing in terms of the discount that you can provide.Amnon Shashuasenior vice president at Intel and CEO of Mobileye

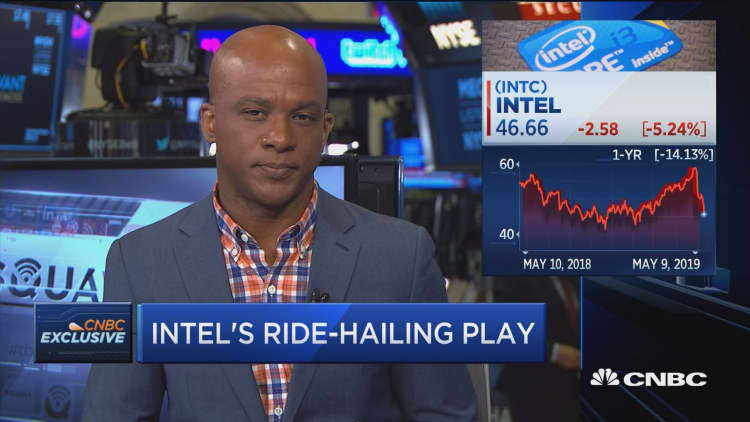

For the past six months, Mobileye has been conducting what Amnon Shashua, senior vice president at Intel and CEO of Mobileye — the Israel-based autonomous driving company that Intel bought for $15 billion in 2017 — called a "very, very deep study, a deep dive study" about the economics of a mobility as a service. That's the buzz term that borrowed from the big success of software as a service companies and has been coined to, among other things, pitch the Uber IPO to investors as a wholly new industry. But the conclusions of the Mobileye study help to bring MaaS back to reality: winning will be about a factor that always has dominated business competition: creating massive cost savings compared to the status quo economics.

"What is really the game-changing element is going from a human-driven ride-hailing service ... to a robo-taxi service," Shashua said in a recent sit down interview with CNBC's Jon Fortt in New York City. "Where the driver today is 80% of the economics. Once you remove the driver and you replace it with capex — the cost of the car, the cost of the technology, and you can, you can have the cost of technology for a few tens of thousands of dollars ... it is game-changing in terms of the discount that you can provide on the current ride hailing business, 40% to 50% discount on the existing ride hailing service, and still make a viable business; viable in terms of high profitability."

Shashua claims no breakthrough idea in focusing on the economics. "You can look at what Uber and Lyft are doing. They clearly state the next phase of their evolution is having robo-taxis. Because they also understand the game-changing effect. It's not that we all of a sudden discovered the game-changing effect."

Two transformative cost phases

Lyft's founders have said the market they are chasing is $1.2 trillion and their path to profits is convincing consumers it is cheaper to hail a ride than own a car. "If you believe in the idea that Americans are spending $9,000 every year owning and operating a car they use 5% of the time, and we can make that more efficient and save people thousands and thousands, then this is right for you," Lyft co-founder John Zimmer told CNBC on the day of its March public debut.

The Mobileye co-founder says that a self-driving system can be estimated at a cost of tens of thousands of dollars today and as a capex investment for a company that is reasonable, but not as a cost to pass along to passenger car consumers. Shashua says the real cost savings is in the autonomous driving cost curve coming down drastically, and that will have two transformative phases.

The first transformative phase brings down the cost per mile "considerably," reaching the cost per mile of car ownership. "That's transformative."

The second phase will come when the cost of the self-driving system goes down by an order of magnitude ten times to a few thousand dollars.

"Passenger cars cannot [put in] technology that costs tens of thousands of dollars because somebody needs to make a profit."

Intel has its own market issues right now. The chip giant has slashed financial guidance recently, including on Thursday at an investor day when it gave a weaker three-year outlook. A slowdown in its legacy processor business for PCs is among the reasons for its interest in growing markets like data centers and potential markets of the future such as autonomous driving.

Building a self-driving system

Mobileye's system uses camera, lasers and radar to guide vehicles, with the central element being the camera system.

"Driving assist is a volume business," Shashua said. "It's tens of millions of cars. In a volume business, you cannot image systems in a car that costs more than a few hundreds of dollars, and if it is camera-based than we know the maximum, it's a few hundreds of dollars. You can equip a car with surround cameras, high-performance computing and it will not cost more than a few hundreds of dollars."

Of course there is going to be a lot more than just cost that puts the self-driving competition to the test.

"On top of the self-driving system, in order to create mobility as a service ... here's routing optimization, there's demand analysis — where to place the robo-taxi at a strategic position such that when a customer hails for a service within a minute the car arrives at the point, handle peak hours, fleet mixes, tele-operation," Shashua said.

And humans will continue to have a job to do. "At some point, the car may get stuck, so you need a human in the loop. One human per say dozens of robo-taxis in order to either call a first responder or do something about it," he said. "At Intel, we're going to partner, develop, acquire all those necessary elements on top of the self-driving system which we're already developing in order to create a mobility as a service business. Acquire, develop or partner – for every component, one of those things will happen," Shashua said.

Shashua thinks will eventually converge to a small number of players, "single-digit number of players" that can not only build the technology, but validate it and work with regulatory bodies to put these cars on the road.

When your computer crashes, no human life is at stake. I think this is this is the big difference between AI for autonomous driving and AI of algorithms for, you know, recommending commercials when I'm on social networks.Amnon Shashuasenior vice president at Intel and CEO of Mobileye

Mobileye has published a formal safety model while working with regulatory bodies around the world. The company also has a planned rollout of a robotaxi service in a venture with Volkswagen, and in its home market of Tel-Aviv, Israel starting this year and scheduled for commercial launch in 2022. It already has tested self-driving cars in Jerusalem.

"That is a very, very important sandbox because that launch includes a complete mobility as a service. It's a service launch, it's a commercial. It's not a pilot. It's not a testing. No drivers are going to be behind the steering wheel and we need to provide the full service. That will be a very, very important sandbox in order for us to build this service."

Shashua also noted that Israel provides self-driving cars with important agility tests.

"We are testing those vehicles in very challenging conditions. Driving in Israel is challenging, driving in Jerusalem is more challenging, driving in scenarios where lots and lots of people are not respecting the rules of the road. Narrow streets, roundabouts."

The Intel executive is aware of how critical safety will be. Mobileye camera technology was in use at Tesla at the time of one of the earliest fatal crashes involving a car using a self-driving technology. Mobileye and Tesla parted ways after the incident and Shashua has spoken critically about Tesla.

"If your smartphone crashes, nothing happened. So, you'll reboot it and that's it. With cars you cannot afford that ... you cannot afford mistakes; especially when talking about autonomous cars. "The level of accuracy that you need to reach with your AI is really unprecedented when you think about consumer products. You can't afford failure. ... You have to guard against failure because humans lives are at stake. When your computer crashes, no human life is at stake. I think this is the big difference between AI for autonomous driving and AI of algorithms for, you know, recommending commercials when I'm on social networks."

"Autonomous driving is such a beautiful thing because it is really a very natural case study for artificial intelligence. It has all the components including ethics; all the components that that that that you need to grapple with when you're talking about artificial intelligence. It has perception. You need to understand the world around you so all the pattern recognition that we humans do effortlessly, which are very, very difficult to do, a computer needs to do. It has decision making; merging into traffic is decisions, right? You are negotiating with other road users you are making decisions. Should I give way to that vehicle? Should I take way of that vehicle? This old, old decision making. ... What's nice about autonomous driving is that this is a huge AI problem that has a huge business. It has a huge transformative business."

Note: Shashua conducted a full-length, in-person interview with CNBC's Jon Fortt at a studio in New York City. These comments are based on a written transcript of that interview and have been edited and condensed for clarity.