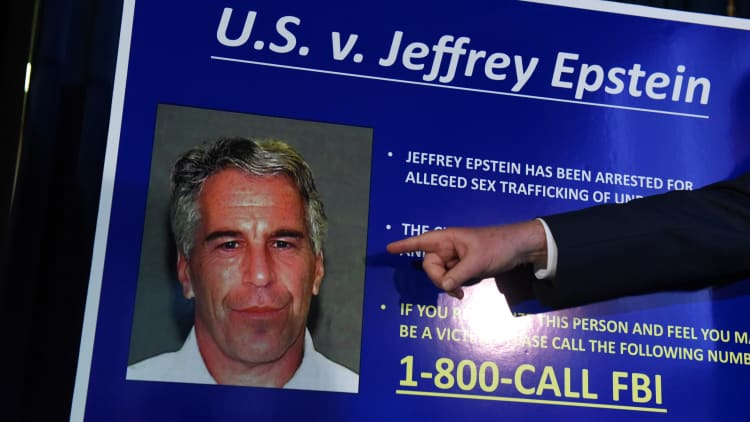

A long battle lies ahead as Jeffrey Epstein's estate grapples with legal claims over the distribution of his assets.

The 66-year-old financier was facing federal charges of sex trafficking minors and sex trafficking conspiracy. He drew up his will on Aug. 8, just two days before he was found dead in a Manhattan jail cell.

His death was ruled a suicide by hanging.

The will details Epstein's property as being valued at more than $577 million, including fine arts, antiques and collectibles whose value is yet to be determined.

This is well over the $11.4 million per individual federal estate and gift tax exemption for 2019 — the maximum amount you can transfer to your heirs without being subject to the 40% federal estate or gift tax.

Perhaps the most glaring issue in the document is the fact that the will was drawn up so close to his date of death.

"The time to do your will is not two days before you die," said Bruce Steiner, who is of counsel at Kleinberg Kaplan in New York. "You'll have higher odds of getting something wrong if you rush the process."

Attorneys anticipate a lengthy fight in court as alleged victims file claims against the money manager's estate.

"This estate will be mired in litigation for a long time until the plaintiffs are paid," said Russell Fishkind, a partner in the personal wealth, estates and trusts practice at Saul Ewing Arnstein and Lehr in New York.

1. Creditors are first in line

The first article in Epstein's will calls on his executor to pay from the estate a litany of costs, including funeral and burial expenses, administration costs and "all of my debts duly proven and allowed against my estate."

The will also directs the executor to give all of Epstein's property after these payments and distributions to The 1953 Trust, which was also established Aug. 8.

How the trust would ultimately be distributed was not clear, as the trust document was not attached to the will.

The will is available here.

"Article One of the will directs the executor to pay debts duly proven and allowed against the estate, and to the plaintiff's attorney that's the green light," said Fishkind.

"That's standard language in the will: You settle claims before you distribute the residuary," he said.

This means creditors, including plaintiffs who receive a judgment in their favor against the estate, are in line to get paid before property passes through to the heirs.

"If you're the executor of the estate, before you can distribute meaningful assets to your remainder person, you must satisfy the creditors," Fishkind said.

2. Trusts aren't always bulletproof

Trusts are valuable because they dictate how inherited assets are managed and distributed. They may also provide creditor protection.

Here's a catch: Not all trusts offer the same level of protection.

Irrevocable trusts generally can't be changed by the grantor once they've been established. Once you've moved the assets to this trust, they're out of your estate so you save on taxes at death.

You've also relinquished control of the asset, which is why these trusts offer creditor protection.

Revocable trusts have provisions that can be revised by the grantor during his or her life. Because the terms can change, the assets are still viewed as being owned by the grantor.

This makes them subject to estate taxes and seizure from creditors.

If you're the executor of the estate, before you can distribute meaningful assets to your remainder person, you must satisfy the creditors.Russell Fishkindpartner at Saul Ewing Arnstein and Lehr

"You don't save on estate taxes when you create a revocable trust," said Charlie Douglas, president of HH Legacy Investments in Atlanta.

The language in Epstein's will suggests that The 1953 Trust is a revocable trust.

Further, while moving your assets to an irrevocable trust may protect them from creditors, it won't work if you're facing legal claims.

"There's something known as a fraudulent conveyance where you know you're going to be sued and your motive is to create the trust to protect it from would-be creditors," said Timothy Speiss, co-leader of the personal wealth advisors group at Eisner Amper in New York.

3. Keep residency in mind

Epstein was a resident and domiciliary of St. Thomas in the U.S. Virgin Islands, but his will lists five properties, including a mansion in New York City.

The other properties, all owned by corporations of which he owns shares, are in Stanley, New Mexico; Palm Beach, Florida; Paris; and the Virgin Islands.

The Empire State is known for chasing down well-to-do residents who claim to live in tax-free havens like Florida, conducting non-residency audits and socking them with taxes owed.

Sizable estates can lead to considerable revenue for New York.

The Empire State has a top estate tax rate of 16%, and an exclusion amount of $5.74 million for people who die in 2019 — far below the $11.4 million per person exemption for the federal estate levy.

More from Personal Finance:

Five reasons your high-tax state won't let you move out

Why you should rethink getting an adjustable rate mortgage

Borrowing from your 401(k)? What you should know

There could be a chance New York could seek its share of state income and estate taxes, said Steiner of Kleinberg Kaplan.

You can have many residences, but what state auditors want to know is "where are you domiciled?"

That's a matter of facts and circumstances: your voter's registration, your driver's license, the location of your family and cherished belongings.

Spending 183 days in your "new" state alone isn't enough to ward off an audit from a high-tax state.

"When you're away somewhere, which residence is the place that you come back to?" asked Steiner. "You want to make your domicile as clear as you can. You don't want your case to be a close call."