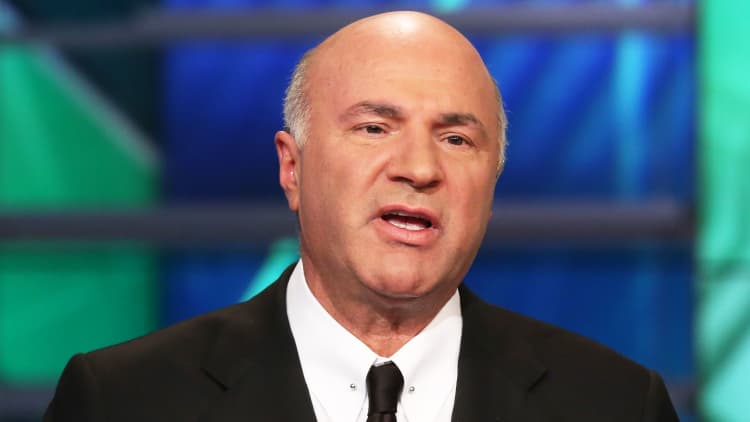

Kevin O'Leary disagreed with fellow "Shark Tank" investor Mark Cuban, saying Tuesday he believes publicly traded companies that qualify should not hesitate to access money through the newly created small business loan program.

"You have a fiduciary responsibility when the government lays out a program to use it because you have no idea how long this pandemic is going to go for, when or if there's going to be therapeutics or a vaccine," O'Leary said on CNBC's "Squawk Box." "You just don't know."

O'Leary, known as "Mr. Wonderful" on "Shark Tank," was responding to comments made on Monday by Cuban. The billionaire entrepreneur and owner of the NBA's Dallas Mavericks criticized companies such as Shake Shack for applying for loans through the Paycheck Protection Program, part of last month's $2.2 trillion outbreak relief package.

The burger chain initially received a $10 million loan through the program. But days later, the company announced it would be returning the money after accessing accessing other kinds of capital through the public markets. It also said the rules for the program were confusing.

Ruth's Chris Steak House and Potbelly also disclosed they have accessed PPP loans, which are available for businesses with 500 or fewer employees. Hotel chains and large restaurants were able to get an exemption for locations that have less than 500 workers.

O'Leary, chairman of O'Shares ETFs, said it is "valid" for companies to make a "marketing decision" to return the money after facing criticism.

But he said he believes the uncertainty around the coronavirus pandemic — and the lost revenues associated with it — is too great to not tap into every type of government support. "If I were a shareholder of Shake Shack, and I'm not, I would've questioned that decision" to return the money. He added, "They'll look pretty foolish if a year from now we're still talking about this pandemic in the same way."

Shake Shack did not immediately respond to CNBC's request for comment on O'Leary's comments.

Randy Garutti, CEO of Shake Shack, told CNBC on Monday the company had secured its "long-term stability." In returning the PPP money, he said, "now it's time for us to help our friends in the industry do the same."

The Paycheck Protection Program was initially funded with $349 billion, but it ran out of money last week. The Senate could potentially vote on Tuesday to add money to the program.

— Disclosure: CNBC owns the exclusive off-network cable rights to "Shark Tank," on which Kevin O'Leary is a co-host.