Some policy experts were quick to sound an alarm after President Joe Biden announced a sweeping new plan Wednesday to cancel up to $10,000 in federal student loans for borrowers with incomes under $125,000.

Biden will cancel up to $20,000 for recipients of Pell Grants.

The plan, these experts say, will cost taxpayers and does nothing to solve the tough unaffordability issues that plague higher education in the U.S.

"There's a transfer of wealth from the society at large to people who borrowed to go to college right now," said Andrew Lautz, director of federal policy at the National Taxpayers Union.

More from Personal Finance:

Biden cancels $10,000 in federal student loan debt for most

Biden's forgiveness plan: How it works, when to apply

Timeline: Key events on the path to student loan forgiveness

Student loan pay pause extended through December

What President Biden's student loan forgiveness means for taxes

Lawmakers, consumer groups push back on forgiveness

"That has consequences for consumers," Lautz said. "It has consequences for taxpayers."

The average burden per U.S. taxpayer will be $2,503.22, according to new estimates from the National Taxpayers Union that are based on the plan released this week.

That's up from the group's previous analysis, which estimated Biden's plan could cost the average taxpayer $2,085.59 based on the $10,000 in forgiveness per federal student loan borrower that had been anticipated.

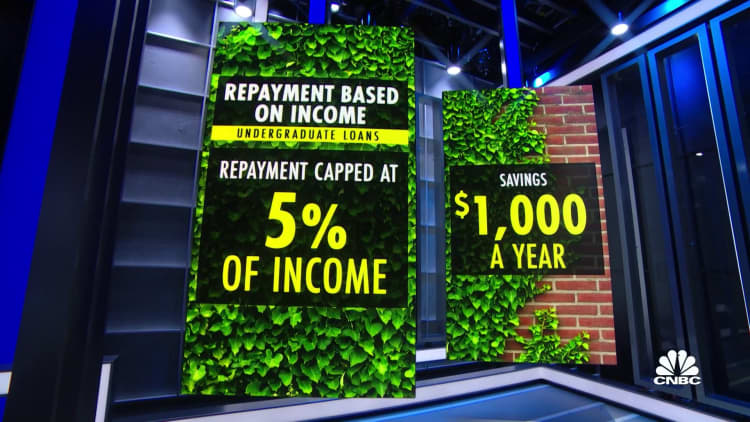

The plan unveiled this week would be even more costly, largely due to an additional $10,000 in debt cancellation for up to 27 million Pell Grant borrowers. It also puts a 5% cap on repayment of undergraduate loans in relation to monthly incomes.

Different tax impacts across income spectrum

"It will raise the costs or budget impact of the policy overall," Lautz said.

To be sure, the estimated cost per taxpayer is based on the assumption that policymakers would need to make up for the total cost of the forgiveness through tax increases, spending cuts, borrowing or a combination of those strategies.

Notably, the costs would not be spread evenly across the income spectrum, according to the National Taxpayers Union's estimates. Low-income taxpayers earning between $1 to $50,000 would have an average additional cost per taxpayer of $190. That would increase to about $1,040 for those with adjusted gross incomes between $50,000 and $75,000; $1,774 for those between $75,000 and $100,000; $3,791 for incomes of $100,000 to $200,000.

Taxpayers with the highest incomes, between $200,000 to $500,000, would have an average additional cost of $11,940.The National Taxpayers Union's latest calculations are based on an estimated $395 billion in net costs to taxpayers, based on a range of $386 billion and $405 billion in net costs to taxpayers.

Meanwhile, the Penn Wharton Budget Model now estimates debt cancellation alone will cost up to $519 billion. Loan forbearance will cost another $16 billion, the research found, while the new income-driven repayment could cost $70 billion.

About 75% of the student loan debt cancellation will benefit households earning $88,000 or less per year, according to the Penn Wharton Budget Model.

The Congressional Budget Office has yet to evaluate the total cost of the policy.

'Shifting one kind of borrowing to another'

Canceling student debt will boost near-term inflation more than the Inflation Reduction Act that was recently enacted would reduce it, the Committee for a Responsible Federal Budget found in a recent analysis. Moreover, it found that canceling student debt would also undermine the deficit reductions in that law recently passed by Democrats.

"I think this is going to surprise on the upside of the costs," Maya MacGuineas, president of the Committee for a Responsible Federal Budget, said after Biden unveiled the plan Wednesday.

The Committee for a Responsible Federal Budget estimates Biden's debt cancellation plan will cost between $330 billion and $390 billion.

While the move will erase debt for millions of student loan borrowers, it also means the government will borrow on their behalf to pay for it.

"This is not paid for," MacGuineas. "This is just shifting one kind of borrowing to another."

Biden's forgiveness plan fails to get at the root cause of why student borrowers wind up with such huge debt burdens in the first place, both Lautz and MacGuineas said.

"Higher education is one of the most difficult, thorny problems that you really need to get into how universities and graduate schools are financed and what kinds of changes would make it more affordable," MacGuineas said. "This accomplishes none of that."