European markets jumped on Thursday afternoon after October's reading of U.S. consumer prices offered hope that inflation stateside has peaked.

European markets

The pan-European Stoxx 600 closed 2.8% higher after the CPI print was published. Tech stocks ended up 7.6%, leading gains as the majority of sectors and all major bourses closed in positive territory. Oil and gas stocks were the sole outlier by the close of play, ending down 0.4%.

The U.S. consumer price index — a broad measure of inflation — rose by 0.4% in October from a month ago. On a year-over-year basis, the CPI rose 7.7%. Economists polled by Dow Jones had projected a monthly incline of 0.6% and an annual rise of 7.9%.

Control of the U.S. House and Senate was still up in the air Wednesday, as states across the country tallied votes in neck-and-neck midterm election races.

While Republicans are expected to win control of the House, they're set to gain fewer seats than initially thought. Meanwhile, Democrats have so far gained one Senate seat.

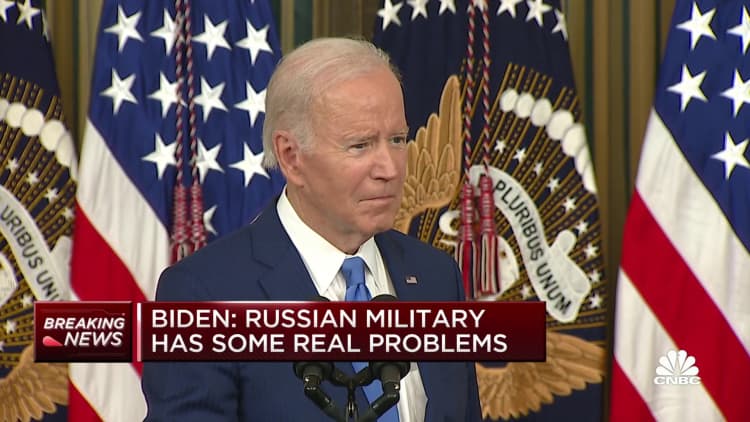

President Joe Biden said his Democratic Party beat back expectations of a strong Republican performance on Election Day.

"It didn't happen," the president said of predictions of a "red wave" that would lead to the GOP holding a strong grip on the House and Senate.

Biden said he is "prepared to work" with Republicans if they win control of one or both chambers of Congress. He added that he expects to speak soon to House Minority Leader Kevin McCarthy, the most likely next House speaker if the GOP flips the House.

Global investors are also awaiting new inflation data out of the U.S. on Thursday, which will be an important marker for the Federal Reserve ahead of its next policy meeting in December.

U.S. stocks soared in morning trade following the October inflation report.

Shares in Asia-Pacific closed in mixed territory earlier in the day as data revealed that China's annualized producer prices fell in October for the first time since December 2020.

— CNBC staff contributed to this markets blog.