As the rate of inflation continues to fall, Social Security beneficiaries may expect to see a much lower cost-of-living adjustment for 2024.

The Social Security COLA may be 3%, according to a new estimate from The Senior Citizens League, a nonpartisan senior group, based on new consumer price index data for June released on Wednesday.

The estimate is higher than the 2.7% increase for 2024 the group projected last month due to changes in the average monthly rate of inflation, according to Mary Johnson, Social Security and Medicare policy analyst at The Senior Citizens League.

More from Personal Finance:

Here's the inflation breakdown for June, in one chart

Social Security phone disruptions have led to longer wait times

How to protect your money from inflation

Separately, the Committee for a Responsible Federal Budget issued its own Social Security COLA estimate on Wednesday that anticipates a benefit increase for 2024 in the range of 2.6% to 3.3%.

The 3.3% increase would happen if recent inflation trends continue, according to the public policy organization focused on federal budget and fiscal issues. A lower 2.6% rise would happen if there is no net inflation for the rest of the year, according to the forecast.

The projected increases to benefits for next year would fall short of the 8.7% rise beneficiaries saw in 2023 — the highest boost in four decades. In 2022, beneficiaries saw a 5.9% increase, which was also a record increase at the time.

Social Security benefits rose by more than $140 per month on average starting in January, according to estimates from the Social Security Administration. The increase applied to about 70 million Social Security and Supplemental Security Income, or SSI, beneficiaries.

The purpose of the cost-of-living adjustment is to ensure benefits keep up with inflation.

The largest recorded COLA — 14.3% — went into effect in 1981. In other years — 2010, 2011 and 2016 — beneficiaries saw no benefit increases.

3 more months of data before official COLA

To be sure, the estimate is preliminary and may change before the Social Security Administration announces the COLA for 2024 in October.

"It is not uncommon for this average monthly rate to change," Johnson said. "That's what changes every single month and that's why the COLA estimate changes."

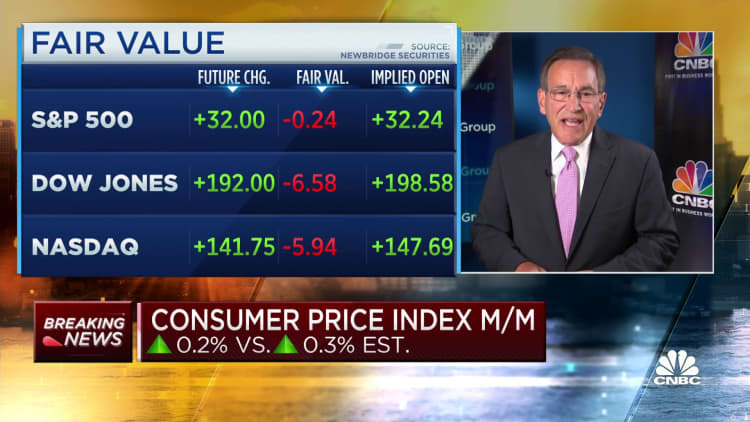

The consumer price index rose 3% from one year ago as of June, according to data released Wednesday.

The Social Security Administration uses a subset of that index — the consumer price index for urban wage earners and clerical workers, or CPI-W — to calculate the annual COLA.

The COLA is based on the percentage change in the CPI-W from the third quarter of last year to the third quarter of the current year. If there is no increase, there is no COLA.

The possibility that the COLA could be zero next year looks unlikely, Johnson noted.

2023 COLA has led to 'some catching up'

The 8.7% cost-of-living adjustment has outpaced year-over-year increases in the CPI-W for every month since the increase kicked in in January. The latest June data shows the CPI-W is up 2.3% over the last 12 months.

In contrast, the 5.9% boost to benefits in 2022 mostly was behind the pace of inflation.

"There has certainly been some catching up that has occurred," Johnson said of this year's benefit increase.

However, retirees and other beneficiaries may find the cost-of-living adjustment doesn't necessarily match up with the cost increases they personally see.

"It's a very unusual occurrence for it to ever really match up very well," Johnson said.

About 53% of beneficiaries have said their actual costs have risen more than the dollar amount of their cost-of-living adjustments, according to The Senior Citizens League's research.