Families preparing for Thanksgiving will find that turkeys are cheaper this year. The U.S. bird population recovered from last year's avian flu, boosting supply and helping push down prices.

This year, a 16-pound frozen whole turkey costs $27.35 on average, a 5.6% decrease from 2022, according to the American Farm Bureau Federation's Thanksgiving Dinner survey, which polled respondents from all 50 states and Puerto Rico in early November. The cost of turkey represents 45% of the classic Thanksgiving basket of food prices the bureau tracks.

Yet Americans are bracing for high price tags across the supermarket aisles.

"Inflation is still clearly impacting food prices," Veronica Nigh, senior economist of AFBF, said in a press call.

More from Personal Finance:

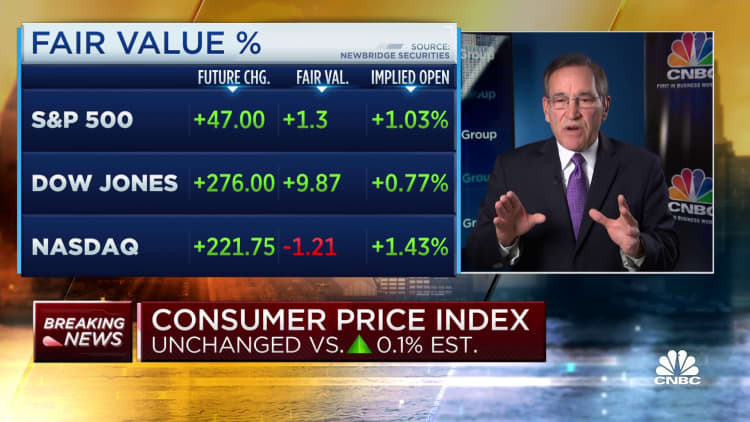

UBS projects inflation is coming to an end

Here's the inflation breakdown for October 2023

Donating a used car may be a charitable gift

About 60% of people celebrating Thanksgiving said inflation is affecting their budgets, a recent LendingTree survey found. To lower costs, 39% plans to shop around and use coupons.

"People are paying more at the grocery store and if they want to save money and spend less, they have to do more work in terms of looking for deals and being flexible about what they're buying," said Kimberly Palmer, personal finance expert at NerdWallet.

Ham, sweet potatoes are more expensive

While food inflation has slowed, this year's celebration won't be less expensive, because costs are still rising. There's also a record spread between the wholesale prices supermarkets pay and the retail prices consumers pay.

The difference is impacting some popular dishes. For example, retail prices for ham — which some families serve instead of, or in addition to, turkey at Thanksgiving — are near an all-time high, with a price tag of $4.56 per pound in September, up 5.2% from last year, according to a recent Wells Fargo report.

Sweet potatoes, a Thanksgiving side-dish staple, are also up 4% from a year ago, and russet potato retail prices are at all-time highs, costing $1.17 per pound in September, 14% up from a year ago, Wells Fargo found.

This is not a situation where shoppers should take a relaxed approach, said Mark Hamrick, senior economic analyst for Bankrate. Shoppers must compare prices and promotions across stores, as "there are good deals to be found," he added.

Fresh foods are cheaper than canned products

High energy and raw material costs are the price-increase culprits for processed foods like canned green beans, which are up almost 9% from last year, Wells Fargo found.

Farmers are experiencing high fuel, seed, fertilizer and transportation costs, according to AFBF.

People are paying more at the grocery store.Kimberly Palmerpersonal finance expert at NerdWallet

Processed foods are also more sensitive to factors involving packaging costs and the supply chain, said AFBF economist Nigh. Climate change also has the potential to create issues in the supply change, said Hamrick.

Consumers can expect to pay around 20% less for fresh cranberries compared to a year ago while canned cranberry sauce is up 7% from last year, Wells Fargo found. Prices for canned pumpkin also increased and are about 30% higher from last year.

While weather and disease last year affected lettuce crops and inflated prices in November 2022, Americans looking to include leafy greens in their Thanksgiving menus can expect prices 10% lower from a year ago.

Buy your Thanksgiving bird sooner

While you may score some turkey deals the closer you get to the holiday, the major caveat to waiting last minute — in addition to less defrosting time — is a higher chance of not finding the exact size bird you're looking for, said economist Nigh.

Given demand for this key Thanksgiving item, buying your turkey "sooner is probably better than later," said Hamrick.

To maximize savings at the grocery store, plan out exactly what you need to buy and make sure you have a complete shopping list before you show up to the store, said Palmer.

"A lot of people waste money by buying things that they end up wasting," she said.

Use search products, such as shopping apps, to help determine which stores have lower prices for items on your list. It "might actually be cheaper to go to a grocery store that you're not used to going to," Palmer said.

Consider opting into supermarket loyalty programs. You can pull in more savings than expected by giving your phone number and email, said Palmer.

As 41% of potential hosts plan on using a credit card to pay for Thanksgiving expenses, per LendingTree, leverage credit cards that offer bigger rewards on groceries.

"Certainly credit card rewards can help extend your holiday budget but if you use them in tandem with other things like grocery store memberships, then it can help even more," said Matt Schulz, chief credit analyst at LendingTree.

However, make sure you pay off the balance by the end of the month, otherwise "the amount you're paying on interest wipes out any benefit of those rewards," added Palmer.

Another way to save: Ask guests to pitch in. As potential hosts face financial strain, 61% of guests will and contribute a dish, whether that means bringing a homemade side dish (46%), a dessert (30%) or alcoholic beverages (19%), LendingTree found.

"Everybody knows that life is expensive right now," said LendingTree chief analyst Matt Schulz. "Chances are they'll be willing to help out because they know they would want help if the shoe was on the other foot."