One lucky winner in Florida is poised to take home the $450 million Mega Millions jackpot.

The winning numbers for Friday's drawing were 28, 30, 39, 59 and 70, plus Mega Ball 10.

The $450 million jackpot ranks as the fourth largest in the game's history, and the second largest awarded to a single ticket. At least for now, it's also the 10th largest jackpot in U.S. history.

Of course, that lucky winner won't walk away with the full amount. If the winner opts to take the $281.2 million lump sum, lottery site USAMega.com estimates the federal tax withholding would be $70.3 million. That is just the amount withheld up front; the final tax burden is likely to be even higher.

Yet the winner has an extra bit of luck: Florida does not have a state income tax. Compared to other states' rates, that's a savings of up to $24.8 million in taxes withheld up front. (Plus, the winner may benefit from tax law changes, including a reduction in the top tax rate from 39.6 percent to 37 percent.)

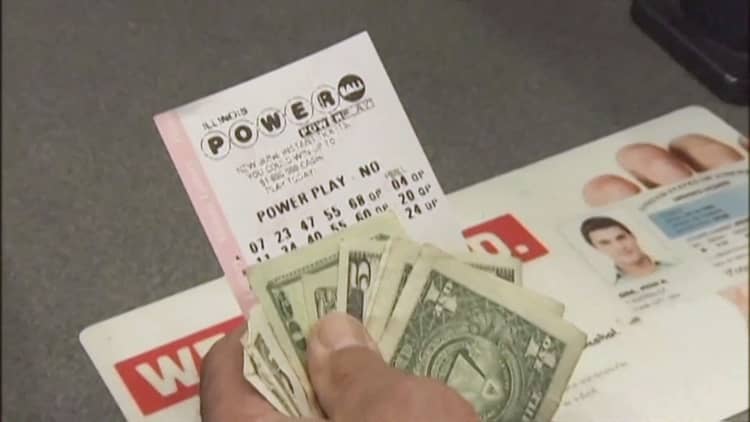

Would-be millionaires have another chance to win big in Saturday's Powerball drawing, which takes place at 10:59 p.m. ET.

At $570 million as of early Saturday, the Powerball jackpot would be that game's fifth largest. It would also be the seventh largest jackpot in U.S.lottery history (knocking Friday's Mega Million win out of the top 10.)

The estimated federal tax withholding on the $358.5 million lump sum would be $89.6 million, according to USAMega.com. State taxes would take up to another $31.6 million, with New York as the worst offender.

More from Your Money, Your Future:

Tax season starts on Jan. 29. Here's when to expect key forms.

New tax law is a mixed bag for your employee benefits

This tax provision helps families save on school costs, taxes